Singapore: Asia’s stock markets were hammered on Friday as panic gripping world financial markets deepened and even safe-haven assets such as gold and bonds were ditched to cover losses in the wipeout. Australia’s benchmark fell as much as 7 percent and is on track for its worst week on record. New Zealand’s index was last down more than 8 percent, its biggest-ever intraday drop.

#CNBCTV18Market | Asia trading with severe cuts, #Nikkei down nearly 1,300 points pic.twitter.com/3374yZAZAN

— CNBC-TV18 (@CNBCTV18Live) March 13, 2020

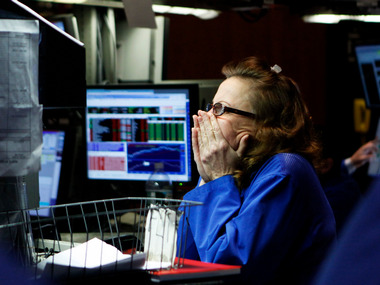

Japan’s Nikkei .N225 fell 7%, while in Korea the Kosdaq fell 8 percent, triggering a 20-minute trading halt. Currency trading was erratic amid poor liquidity and a rush to secure financing in dollars, the world’s top funding currency. After its worst crash since Black Monday in 1987 overnight, Dow futures YMc1 are down about 1 percent in Asia, while S&P 500 futures ESc1 are off 0.7 percent. “There is a sense of fear and panic,” said James Tao, an analyst at stockbroker Commsec in Sydney, where phones at the high-value client desk rang non-stop. “It’s one of those situations where there is so much uncertainty that no-one quite knows how to respond…if it’s fight or flight, many people are choosing flight at the moment.” [caption id=“attachment_7168181” align=“alignleft” width=“380”]  A trader watches a monitor displaying stocks on the floor of the New York Stock Exchange. File photo. Reuters[/caption] The plunge, as the coronavirus pandemic spreads, gathered pace after U.S. President Donald Trump spooked investors with a move to restrict travel from Europe, and after the European Central Bank disappointed markets by holding back on rate cuts. Trade was halted on the S&P 500 after it hit downdraft circuit breakers. It fell further when trade resumed, eventually losing 9.5 percent to close 27 percent below February’s peak. Gold XAU=, usually a safe harbour in times of panic, fell 3.5 percent, yields on long-dated U.S. Treasuries shot up, and in currency markets, investors scrambled for dollars.

“We worry that there could be a chance of a dollar funding squeeze,” said Stuart Oakley, Nomura’s global head of flow FX in Singapore, as businesses scramble to borrow dollars to cover liabilities. When everyone does that at the same time, it can result in a massive demand for dollars. And ultimately…there becomes a shortage, and the dollar funding level explodes.”

In a televised address late on Wednesday, US President Donald Trump imposed restrictions on travel from Europe to the United States, shocking investors and travellers. Traders were disappointed after hoping to see broader measures to fight the spread of the virus and blunt its expected blow to economic growth. The New York Federal Reserve surprised by pumping huge amounts of cash into the banking system, aiming to head off the sort of dislocation that saw markets seize up during the financial crisis. After adding $500 billion on Thursday, it will inject another $1 trillion today in an effort to stop borrowing costs from rising. MSCI’s gauge of stocks across the globe shed 9.51% and was down more than 20 percent from its 52-week peak. The VIX volatility index - Wall Street’s “fear gauge” and an equivalent measure of volatility for the Euro Stoxx 50 hit their highest since the 2008 financial crisis. In early Asia currency trade volumes were light and tight liquidity exaggerated moves. The dollar handed back some gains to the yen, pound and franc and Australian dollar lifted almost 1 percent from an 11-year low to $0.6271. The euro found footing at $1.1184 after falling as far as $1.1054 overnight.

)

)

)

)

)

)

)

)

)