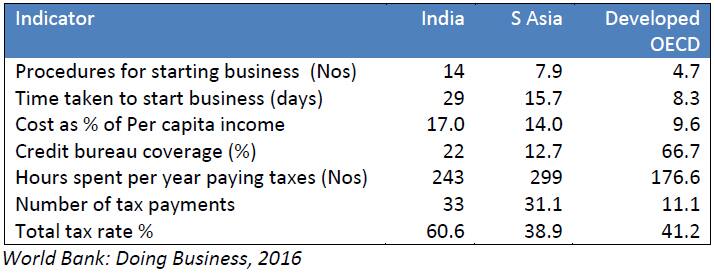

For prime minister Narendra Modi’s ‘Start-Up India, Stand Up India’ campaign to give intended results, the government needs to further ease up processes to start up businesses in India, a report by CARE Ratings has said. The government should make available simple online forms for registration of these units and also put in place a system to grant approvals in a time-bound manner, said the report. “This will cut down the time taken to commence operations as well as reduce the human interface making the system more efficient. Ongoing compliances also must be streamlined with less human-interface and paper work,” the report said. [caption id=“attachment_1612537” align=“alignleft” width=“380”]

Thinkstock[/caption] Media reports had earlier claimed that the government is working on steps to boost the entrepreneurship in India. According to a

report

in The Economic Times, the government is planning to offer tax breaks, set up incubation centres and easier approval processes. Jayant Sinha, minister of state for finance, had in October said that the prime minister is likely to

make a series of important announcements

in December about how the government plans to take forward the country’s entrepreneurial system. The CARE Ratings report assumes significance in this context. “The growth of start-ups will be an important factor in the quest for the Make in India campaign come true as it will be driven by these entrepreneurs - more often than not, first time ones,” the report has said.

Thinkstock[/caption] Media reports had earlier claimed that the government is working on steps to boost the entrepreneurship in India. According to a

report

in The Economic Times, the government is planning to offer tax breaks, set up incubation centres and easier approval processes. Jayant Sinha, minister of state for finance, had in October said that the prime minister is likely to

make a series of important announcements

in December about how the government plans to take forward the country’s entrepreneurial system. The CARE Ratings report assumes significance in this context. “The growth of start-ups will be an important factor in the quest for the Make in India campaign come true as it will be driven by these entrepreneurs - more often than not, first time ones,” the report has said.

The ‘Start-up India, Stand up India’ programme envisages that each of the 1.25 lakh bank branches in the country will encourage at least one Dalit or tribal entrepreneur and one woman entrepreneur. Here are the other three important steps that the ratings agency has listed out for the government to boost entrepreneurship in India: Funding issues: Besides institutional funding, the government should look at non-conventional sources that can buoy the sector. These include FDI with an upper limit, angel investors and PE funds and crowd funding with SEBI to ensure the credibility of the system is not compromised. Banks could be asked to lend to a certain number of start-ups as part of its priority sector lending with a sub-limit of say 1 percent. A government guarantee fund can be set up through MUDRA Bank or SIDBI to cover for potential losses, provide credit rating that is supportive of loans taken by start-up units with a higher rating acting as a booster for the lending equity. Role of the govt: The government must support the start-up ecosystem through incentives and subsidies. This cannot be stopped for an economy which can be driven by innovation and enterprise. The government should look at having a separate department for start-ups, provide incubators at zero/low cost, training facilities for potential employees/consultants, concessions in sales tax and other local taxes, etc. The National Small Industries Corporation Ltd (NSIC) subsidy for SME must be scaled up from the Rs 26 cror for FY16 and a separate provision made for start-ups. The government should consider subsiy at a lower rate for start-ups for a period of five years. Scale up skill development programme: This must be done at different levels so that youth who want to start-up have the necessary skill sets.

The ‘Start-up India, Stand up India’ programme envisages that each of the 1.25 lakh bank branches in the country will encourage at least one Dalit or tribal entrepreneur and one woman entrepreneur. Here are the other three important steps that the ratings agency has listed out for the government to boost entrepreneurship in India: Funding issues: Besides institutional funding, the government should look at non-conventional sources that can buoy the sector. These include FDI with an upper limit, angel investors and PE funds and crowd funding with SEBI to ensure the credibility of the system is not compromised. Banks could be asked to lend to a certain number of start-ups as part of its priority sector lending with a sub-limit of say 1 percent. A government guarantee fund can be set up through MUDRA Bank or SIDBI to cover for potential losses, provide credit rating that is supportive of loans taken by start-up units with a higher rating acting as a booster for the lending equity. Role of the govt: The government must support the start-up ecosystem through incentives and subsidies. This cannot be stopped for an economy which can be driven by innovation and enterprise. The government should look at having a separate department for start-ups, provide incubators at zero/low cost, training facilities for potential employees/consultants, concessions in sales tax and other local taxes, etc. The National Small Industries Corporation Ltd (NSIC) subsidy for SME must be scaled up from the Rs 26 cror for FY16 and a separate provision made for start-ups. The government should consider subsiy at a lower rate for start-ups for a period of five years. Scale up skill development programme: This must be done at different levels so that youth who want to start-up have the necessary skill sets.

As govt gears up to boost start-ups, here's a wish list to ease up doing business

FP Staff

• December 14, 2015, 14:02:36 IST

It is time the government came out with simpler online forms for registration of units and grant approvals in a stipulated time-frame.

Advertisement

)

End of Article