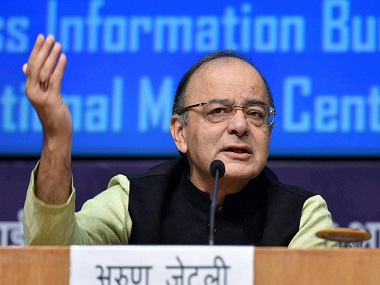

Union finance minister Arun Jaitley on Tuesday made some major announcements, which he dubbed was a thorough and detailed review of the state of the economy. From acknowledging the rise in Non-Preforming Assets to the various questions on the health of economy post demonetisation and GST, Jaitley touched upon a range of issues in an hour-long press conference. The secretaries of different departments in the finance ministry also gave a detailed presentation on the various parameters on the state of the economy. Here are the key takeaways from the finance minister’s mid-term press briefing.

- The Union Cabinet approved an ‘unprecedented’ recapitalisation plan for state-run banks worth Rs 2.11 lakh crore.

- Of this amount, a sum of Rs 1.35 lakh crore will be raised through recapitalisation bonds while another Rs 76,000 crore would be available from budgetary support and raised through market borrowings.

- The exact nature of these recapitalisation bonds will be released later and the capital infusion plan may run into the next fiscal year.

- The government also approved a massive road building programmes of around Rs 7 lakh crore with a target to construct 83,677 km of roads in the next five years. These programmes included that Bharatmala project of around 35,000 km with an investment of Rs 5.35 lakh crore, which is likely to create 14.2 crore man-days of jobs.

- The government has also approved the construction of 2,000 km of roads along the eastern and western borders of the country to boost border roads and international connectivity.

- The infrastructural investments will also focus on building motorable roads in the North East and Naxal-affected regions of the country. Boosting all-round connectivity, the government also approved construction of roads of 10,000 km.

- Jaitley said that the public sector banks have an adequate lending capacity now, post demonetisation.

- The finance minister also claimed that there was a visible rise in the NPAs because they were swept under the carpet for long. “Transparency only came after 2015,” Jaitley added.

- Jaitley said that the state-run banks had been lending indiscriminately between 2008 and 2013. He, however, added that the banks now have adequate lending capacity post demonetisation.

- The finance minister also promised a buoyant economy going forward. He said that the inflation, this year, is expected to remain below four percent.

With inputs from agencies

)