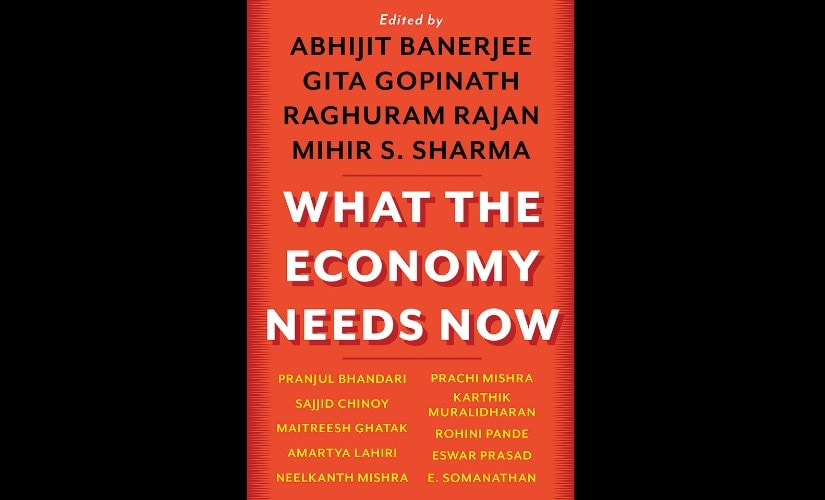

What the Economy Needs Now is a comprehensive look at the biggest challenges facing the Indian economy, including reviews of government policies, with proposals for improvement, focusing on Indian economic growth. Fourteen eminent economists have authored these chapters. Reproduced here with permission from Juggernaut Books is an excerpt from a chapter on banking reforms, by Raghuram Rajan. *** [caption id=“attachment_6600861” align=“alignnone” width=“825”]  What the Economy Needs Now, edited by Abhijit Banerjee, Gita Gopinath, Raghuram Rajan and Mihir S Sharma. Juggernaut Books[/caption] Reviving projects that can be revived The National Company Law Tribunal will help restructure debt for the largest firms and projects under the Bankruptcy Code. However, the NCLT will be overwhelmed if every stressed firm or project files before it. Instead, we need a functional out-of-court restructuring process, so that the vast majority of cases are restructured out of bankruptcy — with the NCLT acting as a court of last resort if no agreement is possible. Both the out-of-court restructuring process and the bankruptcy process need to be strengthened and made speedy. The former requires protecting the ability of bankers to make commercial decisions without subjecting them to inquiry. The latter requires steady modifications where necessary to the Bankruptcy Code so that it is effective, transparent, and not gamed by unscrupulous promoters. Of course, for many projects, financial restructuring is of little use if the project cannot proceed for other reasons such as lack of land or permissions or input supply. Any new government will have to give priority to rectifying these issues. Improving governance and management at public sector banks • Public sector bank boards are still not adequately professionalised, and the government rather than a more independent body still decides board appointments — with the inevitable politicisation. The government could follow the PJ Nayak Committee report more carefully. Eventually strong boards should be entrusted with all bank-related decisions, including CEO appointment, but held responsible for performance. Strategic investors could help improve governance. • Risk management still needs substantial improvement in public sector banks, regulatory compliance is inadequate and cyber risk needs greater attention. Interest rate risk management is notable for its absence, which means banks are very dependent on the central bank to smooth the path of long-term interest rates. These are all symptoms of managerial weakness. There is already a talent deficit in internal public sector bank candidates in coming years because of a hiatus in recruitment in the past. Outside talent has been brought in very limited ways into top management in public sector banks. This deficiency needs to be addressed urgently by searching more widely for talent. Compensation structures in public sector banks also need rethinking, especially for high-level outside hires. Project lending has to be improved • Significantly more in-house expertise can be brought to project evaluation and structuring, including understanding demand projections for the project’s output, likely competition, and the expertise and reliability of the promoter. Bankers will have to develop industry knowledge in key areas or bring on board industry experts, since consultants can be biased. • Real risks have to be mitigated where possible, and shared where not. Real risk mitigation requires ensuring that key permissions for land acquisition and construction are in place up front, while key inputs and customers are tied up through purchase agreements. Government will have to deliver what it is responsible for in a timely way. Where these risks cannot be mitigated, they should be shared contractually between the promoter and financiers, or a transparent arbitration system should be agreed to. • An appropriately flexible capital structure should be in place. The capital structure has to be related to residual risks of the project. The more the risks, the more the equity component should be (genuine promoter equity, not borrowed equity, of course), and the greater should be the flexibility in the debt structure. • Where possible, corporate debt markets, either through direct issues or securitised project loan portfolios, should be used to absorb some of the initial project risk. More such arm’s length debt should typically refinance bank debt when construction is over. • Financiers should put in place a robust system of project monitoring and appraisal, including where possible, careful real-time monitoring of costs. Promoters should be incentivised to deliver, with significant rewards for on-time execution and debt repayment. Projects that are going off track should be restructured quickly, before they become unviable. • And finally, the incentive structure for bankers should be worked out so that they evaluate, design and monitor projects carefully, and get significant rewards if these work out. Equally, bankers who preside over a series of bad projects should be identified and penalised. Privatise or not? Is privatisation of public sector banks the answer? Much of the discussion on privatisation seems to make assumptions based on ideological positions. Certainly, if public sector banks are freed from some of the constraints they operate under (such as paying above the private sector for lowskilled jobs and paying below the private sector for senior management positions, having to respond to government diktats on strategy or mandates, or operating under the threat of CVC/CBI scrutiny) they might perform far better. However, such freedom typically requires distance from the government. So long as they are majority-owned by the government, they may not get that distance. At the same time, there is no guarantee that privatisation will be a panacea. Some private banks have been poorly governed. Instead, we need to recognise that ownership is just one contributor to governance and look at pragmatic ways to improve governance across the board. There certainly is a case to experiment by privatising one or two mid-sized public sector banks and reducing the government stake below 50 percent for a couple of others, while working on governance reforms for the rest. Rather than continuing a never-ending theoretical debate, we will then actually have some evidence to go on. Some political compromises will be needed to allow the process to go through, but so long as the newly privatised banks are not totally hamstrung in their operational flexibility as a result of these compromises, this will be an experiment worth undertaking. Merge or not? An alternative proposal to improve governance is to merge poorly managed banks with good banks. It is uncertain whether this will improve collective performance — after all, mergers are difficult in the best of situations because of differences in culture. When combined with differences in management capabilities, much will depend on whether the good bank’s management is strong enough to impose its will without alienating the employees of the poorly managed bank. We now have two experiments under way: State Bank has taken over its regional affiliates, and Bank of Baroda, Vijaya Bank and Dena Bank have been merged. The performance of the latter merger will be more informative. Thus far, market responses suggest scepticism that it will play out well. Time will tell.

What the Economy Needs Now is a collection of essays by Indian economists, each tackling an issue facing the country, and providing suggestions for economic growth.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)