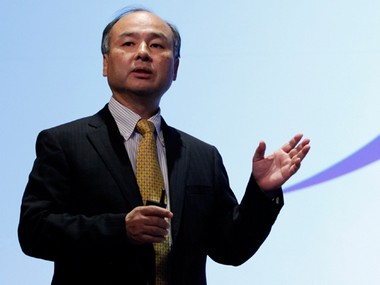

After conflicting reportage that stated SoftBank Group may or may not sell its 20-22 percent stake in Flipkart to US retailer Walmart, comes news about the Japanese Internet giant looking to up its stake in e-commerce platform Paytm Mall. An investment, according to a report in The Economic Times is subject to SoftBank being freed from a restrictive clause that does not permit it to invest over $500 million in Paytm Mall until 2020. In April, SoftBank invested around Rs 2,600 crore ($400 billion) for a 21 percent stake in Paytm Mall, according to a report in VC Circle. The Hindu Business Line on 12 April, citing data by start-up research firm Tracxn, said that SoftBank has invested over $8 billion in the Indian e-commerce and internet spaces over the past five years. SoftBank’s investments in Flipkart In April, the Japanese conglomerate invested around Rs 2,600 crore in Paytm Mall, a report in the Mint said. This investment increased its stake in Paytm to 11.99 percent, a report said. In May 2017, SoftBank pumped in $1.4 billion (over Rs 9,079 crore) in Paytm. The investment came at a time when SoftBank was working on a sale plan of e-commerce firm Snapdeal. SoftBank is the largest shareholder in Snapdeal, which was locked in an intense battle with Amazon India and Flipkart. Softbank backed Snapdeal in the hope that the e-retailer would challenge Flipkart’s dominance in the e-commerce space. However, Snapdeal slipped to a distant third behind Amazon India by 2016, an ET report said. “In line with the Indian government’s vision to promote digital inclusion, we are committed to transforming the lives of hundreds of millions of Indian consumers and merchants by providing them digital access to a broad array of financial services, including mobile payments,” SoftBank Group Chairman and CEO Masayoshi Son said, PTI reported. [caption id=“attachment_4450455” align=“alignleft” width=“380”]  A file photo of Masayoshi Son, CEO, Softbank Group. Reuters.[/caption] SoftBank, which was an early investor in Alibaba, has committed investments of over $10 billion in India. While it has pumped in close to $2 billion into Indian startups like Snapdeal, Ola and Housing.com in last few years, it has also written off a significant portion of that on account of loss in valuation. Will SoftBank exit Flipkart? Sources said to PTI that SoftBank is yet to take a call on exiting Flipkart. The factors that hold key to the decision include the tax SoftBank has to pay on profits it would earn from such share sale. SoftBank had invested $2.5 billion in Flipkart and exiting the company would fetch it up to $4.5 billion. The $2 billion profit would be taxed as per Indian law. Since the profit is made from shares that were held for more than two years, it would attract a long-term capital gains tax of 20 percent plus surcharge and education cess, effectively wiping away a fourth of the profit. Other deciding factors would be Son’s relationship with Walmart and that SoftBank likes to be a long-term investor, sources said, adding the Japanese conglomerate is very bullish on India and sees immense opportunities for growth of investment. When contacted, a SoftBank spokesperson declined to comment. Sources said Walmart had indeed courted SoftBank for buying its shares but the Japanese group has not yet taken a final call on the issue. On 9 May, hours before Walmart was scheduled to announce the Flipkart acquisition, Son told an investor call on his company’s earnings that Walmart would buy a controlling stake in the Indian e-commerce firm. “Last night, (they) reached a final agreement and it was decided that Flipkart will be sold to America’s Walmart,” Son had stated in Tokyo, according to an AFP report. He had gone on to state that the $2.5 billion that the Japanese company through its Vision Fund had invested in Flipkart was worth about $4 billion in the deal. He had not clearly stated if SoftBank had agreed to sell the stake at such valuations. If SoftBank decides not to sell, Walmart would be left with about 55 percent of Flipkart. On 9 May, all significant shareholders in Flipkart, like Naspers, venture fund Accel Partners and eBay, had confirmed they were selling their shares to Walmart. South African internet and entertainment major Naspers, which had invested $616 million in Flipkart in August 2012, sold its entire 11.18 percent stake in the company to Walmart for $2.2 billion. eBay said it is selling its stake in Flipkart for about $1.1 billion.

In April, SoftBank had invested around Rs 2,600 crore ($400 billion) for a 21 percent stake in Paytm Mall,

Advertisement

End of Article

)

)

)

)

)

)

)

)

)