For many, the experience of watching TV over the past few days has been extra pleasant - thanks to the absence of ads. To the broadcasters, the absence of ads, thanks to a dispute with the advertising agencies, is a body blow that is costing them, according to estimates, as much as Rs 30 crore per day.

This is what STAR India has to say on the issue: “Advertisements are not running on this channel because advertising agencies have refused to accept revisions in billing methods which are seen as flawed by tax authorities. We regret any inconvenience, but the STAR Group is committed to doing business with the highest standards of compliance, which reflects the true commercial arrangement between advertisers and broadcasters.”

Last night, after frenetic negotiations, the two warring bodies, the Advertising Agencies Association of India (AAAI) and the Indian Broadcasting Foundation (IBF), thrashed out a compromise formula where the onus is on the AAAI to engage with the Central Board of Direct Taxes to accept the view of the IBF on the dispute by 31 May. If this happens, all is well. If the CBDT does not accept the IBF contention, IBF will stick to their stand on changing the billing system. Till 31 May, however, peace prevails and all ads will be back on air from today.

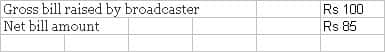

To make the understanding of this disputre easier, this is how advertising billing and transaction, has traditionally worked:

What would happen is that the bill would be raised by the broadcaster on the advertising agency for Rs.100, say. The advertising agency would raise a bill on the client, with the broadcaster’s bill as a supporting document. The client would pay the agency 100 percent of the bill amount. The agency would then retain 15 percent, traditionally the agency ‘commission’ and pay the broadcaster the ’net bill amount’ of 85 percent, deducting TDS on this amount.

The amount of money that flowed into the bank account of the broadcaster has always been 85 percent less TDS, never 100 percent.

[caption id=“attachment_748785” align=“alignleft” width=“380”]

Screen grab of a Pepsi advertisement.[/caption]

Screen grab of a Pepsi advertisement.[/caption]

Impact Shorts

More ShortsThe Income Tax department now is demanding taxes (and back taxes) on the 15 percent that was never paid to the broadcaster – from the broadcaster. While the demand is disputed and fought with the authorities, the broadcasters want to prevent any new demand by the IT department by switching from the earlier ‘gross bill’ to the ’net bill’, leaving no room for ambiguity.

On the surface, there would seem to be no reason for anyone to disagree with the change.

Yet, there is resistance by the advertising agencies, represented by the AAAI.

To understand the first, we need to go back to the origins of the ‘agency commission.’ The first advertising ‘agencies’ brokered space in newspapers on behalf of the owners to advertisers. The compensation for the efforts was in the region of 15 percent. Over time, this 15 percent became the standard commission ‘paid’ by media owners. However, this nomenclature of agencies being ‘paid’ by media owners was always flawed; the agent retained 15 percent from the 100 percent he received from the advertiser and passed on the 85 percent. In effect, the advertiser paid the agency, never the media.

This practice has remained constant over decades.

Since the collapse of the full-service agency model during the 1990s, there were many claimants to the 15 percent that was retained. Media planning and buying was now a speciality offering, and went out of the advertising agencies. Media agencies have been (in India at least) paid 5 percent (if they did both planning and buying, less if they did only one of the two), with the advertising agency now getting 10 percent of the media billing. Again, as the business evolved, the larger clients questioned the traditional 15 percent compensation and negotiated lower percentages. As a result, while the broadcaster still gets 85 percent, the 15 percent is shared by a number of vendors, including advertising and media agencies - and the client as well.

So in many cases, the client’s pay out is less than 100 percent of the ‘gross bill’ amount, since he could be retaining a part of the money. It’s the confusion in this area that seems to be causing the IT department to demand the money from the broadcasters.

But the CBDT view seems flawed. The responsibility for deducting tax at source cannot rest with the final recipient - the responsibility is that of the entity making the payment.

In this case, the responsibility should be with the client, in most part, and with the agencies which make payments to broadcasters.

What emerges is that the entire billing, tax deduction and payment system which has been the practice over decades, is flawed and ill-designed - and the IT department, whatever else it achieves with the demand, has done yeoman service to the industry by drawing attention to the billing mess in advertising.

Anant Rangaswami was, until recently, the editor of Campaign India magazine, of which Anant was also the founding editor. Campaign India is now arguably India's most respected publication in the advertising and media space. Anant has over 20 years experience in media and advertising. He began in Madras, for STAR TV, moving on as Regional Manager, South for Sony’s SET and finally as Chief Manager at BCCL’s Times Television and Times FM. He then moved to advertising, rising to the post of Associate Vice President at TBWA India. Anant then made the leap into journalism, taking over as editor of what is now Campaign India's competitive publication, Impact. Anant teaches regularly and is a prolific blogger and author of Watching from the sidelines.

)