There is no notification yet on the Central Board of Direct Taxes (CBDT) website on change of deadline for linking biometric Aadhaar with Permanent Account Number (PAN), contrary to

media reports stating the deadline is 31 August 2019. As of today, the deadline for linking Aadhaar and PAN is 30 September 2019, according to the CBDT website. This deadline is as per press release dated 31 March 2019 which had fixed the September 2019 deadline. Aadhaar, PAN interchangeable In her Union Budget 2019 speech, Nirmala Sitharaman had mentioned that Aadhaar card and PAN would be made interchangeable.“More than 120 crore Indians now have Aadhaar card, therefore for ease of taxpayers I propose to make PAN and Aadhaar interchangeable and allow those who don’t have PAN to file returns by simply quoting Aadhaar number and use it wherever they require to use PAN,” Sitharaman said. The interchangeability of Aadhaar and PAN as mentioned by the finance minister does not mean there is a relaxation of rules with regard to either, said S Vasudevan, Partner, Lakshmikumaran & Sridharan. It is mandatory to link Aadhaar with PAN for filing Income Tax Return (ITR). In Income Tax, there are various provisions which makes it mandatory to quote PAN number when you undertake certain transactions, said Vasudevan. “What the finance minister is saying is, if you don’t have PAN you may quote Aadhaar. But the procedure says that once you quote Aadhaar, the Income Tax authorities will automatically allot a PAN to the tax payer. It is like: You either come to me and I will allot you a PAN or you apply for PAN on your own. But if you have an Aadhaar, the Income Tax Department will suo moto allot you a PAN number. Once PAN is allotted to the individual, it will be linked to his Aadhaar,” explained Vasudevan. How to link Aadhaar with PAN For those of you who haven’t still linked your Aadhaar with PAN, here is an explainer, from

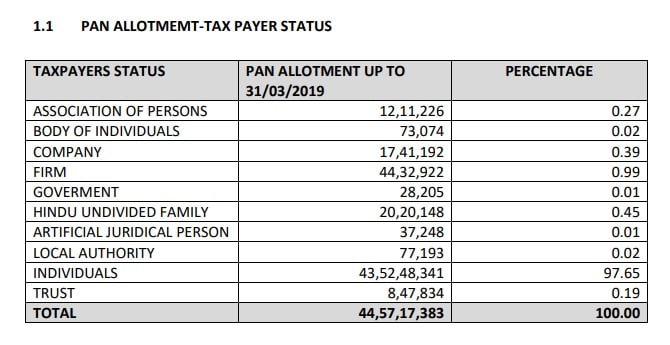

ClearTax People can visit the official e-filing website of the Income Tax department to link the two identities, in both the cases– identical names in the two databases or in case where there is a minor mismatch. [caption id=“attachment_5276941” align=“alignleft” width=“380”] Representational image. News18[/caption] The online linking of Aadhaar number with PAN can be done by logging on to the income tax e-filing portal. Here are two ways of doing it: 1) Either you log on to your account and follow the 6-step procedure Step 1: Register yourself at the income tax e filing portal, if you are not already registered. Step 2: Log in to the e-Filing portal of the Income Tax Department by entering the login ID, password and date of birth Step 3: After logging in to the site, a pop up window will appear prompting you to link your PAN card with Aadhaar card. If you don’t see the popup, go to blue tab on the top bar named ‘Profile Settings’ and click on ‘Link Aadhaar’. Step 4: Details such as name, date of birth and gender will already be mentioned as per the details submitted at the time of registration on the e-Filing portal. Verify the details on screen with the ones mentioned on your Aadhaar card. Step 5: If the details match, enter your Aadhaar number and captcha code and click on the “Link now” button. Step 6: A pop-up message will inform you that your Aadhaar number has been successfully linked to your PAN card. 2) Or follow a two-step procedure by not logging into your account: Step 1: Go to www.incometaxindiaefiling.gov.in and click on the link on the left pane – Link Aadhaar Step 2: Enter the following details: • PAN; • Aadhaar number, and • Name as exactly specified on the Aadhaar card (avoid spelling mistakes) After entering the details click on submit. Post verification from UIDAI the linking will be confirmed. In case of any minor mismatch in Aadhaar name provided, Aadhaar OTP will be required. Please ensure that the date of birth and gender in PAN and Aadhaar are exactly same. In a rare case where Aadhaar name is completely different from name in PAN, then the linking will fail and the taxpayer will be prompted to change the name in either Aadhaar or in PAN database. Use SMS to link Aadhaar number and PAN Now you can link your Aadhaar and PAN through SMS also. The Income Tax Department has urged taxpayers to link their Aadhaar with their PAN, using an SMS-based facility. It can be done by sending an SMS to either 567678 or 56161. Send SMS to 567678 or 56161 from your registered mobile number in the following format: UIDPAN Example: UIDPAN 123456789123 AKPLM2124M Deadline for Aadhaar-PAN linkage extended several times The deadline for linking of Aadhaar with PAN has been changed several times in the past. In March 2019, the government extended the deadline for linking PAN with Aadhaar by six months till 30 September, 2019 as per an official statement. This was the sixth time the government has extended the deadline for individuals to link PAN with Aadhaar. In June last year, the government had said that PAN has to be linked with the biometric ID by 31 March. “….now the cut-off date for intimating the Aadhaar number and linking PAN with Aadhaar is 30 September 2019, unless specifically exempted,” the Central Board of Direct Taxes (CBDT) said in a statement. The CBDT had said there were reports that those PANs which are not linked with Aadhaar number by 31 March may be invalidated, following which the matter was considered by the government and the date extended till 30 September, according to a PTI report. “Notwithstanding the last date of intimating/linking of Aadhaar Number with PAN being 30 September 2019, it is also made clear that w.e.f. April 1, 2019, it is mandatory to quote and link Aadhaar number while filing the return of income,” it added. The apex court, in September last year, had declared the Centre’s flagship Aadhaar scheme as constitutionally valid and held that the biometric ID would remain mandatory for filing of I-T returns and allotment of PAN. A five-judge constitution bench had, however, said that it would not be mandatory to link Aadhaar to bank accounts and telecom service providers cannot seek its linking for mobile connections. Till 31 March 2019, the 44.57 crore PANs issued and over 24.90 crore were linked to Aadhaar.

The Supreme Court in its order upheld section 139AA of the Income Tax Act. Section 139 AA (2) of the Income Tax Act says that every person having PAN as on 1 July 2017, and eligible to obtain Aadhaar, must intimate his Aadhaar number to the tax authorities. The earlier deadlines for linking PAN with Aadhaar were 31 July, 31 August and 31 December 2017, 31 March 2018, 30 June 2018 and 31 March, 2019. However, quoting of Aadhaar will remain mandatory for filing income tax returns (ITRs), following the Supreme Court order.

The Supreme Court in its order upheld section 139AA of the Income Tax Act. Section 139 AA (2) of the Income Tax Act says that every person having PAN as on 1 July 2017, and eligible to obtain Aadhaar, must intimate his Aadhaar number to the tax authorities. The earlier deadlines for linking PAN with Aadhaar were 31 July, 31 August and 31 December 2017, 31 March 2018, 30 June 2018 and 31 March, 2019. However, quoting of Aadhaar will remain mandatory for filing income tax returns (ITRs), following the Supreme Court order.

The interchangeability of Aadhaar and PAN as mentioned by the finance minister does not mean there is a relaxation of rules with regard to either

Advertisement

End of Article

)

)

)

)

)

)

)

)

)