Finance Minister Arun Jaitley will present the Union Budget on 28 February. In order to woo the middle class and to provide a boost to consumption, government may consider raising the limit for exemption for personal income tax. To boost investment, deductions available under various instruments may be raised (including medical due to the rising cost, and housing, in view of its objective for affordable housing).

A report in the Financial Express

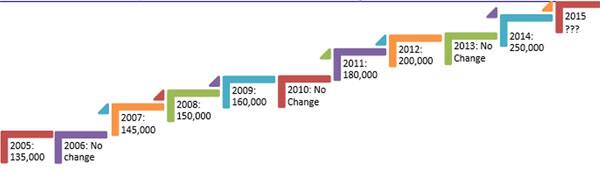

, quoting sources, said finance minister Arun Jaitley may also raise the overall personal income tax exemption level by Rs 1 lakh to Rs 5 lakh. “While the basic exemption limit for individuals (other than senior citizens) could go up from Rs 2.5 lakh to Rs 3 lakh, the investment limit for claiming deduction under Section 80C will increase to Rs 2 lakh from Rs 1.5 lakh at present. The present higher limits for senior citizens would be correspondingly raised.The two measures, together, could result in an annual revenue loss of around Rs 30,000 crore to the government and a corresponding boost to household savings,” the report said. [caption id=“attachment_2116401” align=“aligncenter” width=“600”]

Source: Motilal Oswal[/caption] Moreover, given the thrust on housing, tax incentive for first time buyers could also be included. Fiscal incentive for “Make in India” in the form of higher depreciation and lower taxation can also be a part of the Budget document. For foreign investors, resolution of issues related to transfer pricing, minimum alternate tax (MAT) and mechanism for improving return on infrastructure investments could be announced in the upcoming Budget.

Source: Motilal Oswal[/caption] Moreover, given the thrust on housing, tax incentive for first time buyers could also be included. Fiscal incentive for “Make in India” in the form of higher depreciation and lower taxation can also be a part of the Budget document. For foreign investors, resolution of issues related to transfer pricing, minimum alternate tax (MAT) and mechanism for improving return on infrastructure investments could be announced in the upcoming Budget.

Chart: Middle class can expect some relief as FM may raise income tax exemption to Rs 5 lakh

FP Staff

• February 24, 2015, 10:40:19 IST

Finance Minister Arun Jaitley will present the Union Budget on 28 February. In order to woo the middle class and to provide a boost to consumption, government may consider raising the limit for exemption for personal income tax. To boost investment, deductions available under various instruments may be raised (including medical due to the rising cost, and housing, in view of its objective for affordable housing). A report in the Financial Express , quoting sources, said finance minister Arun Jaitley may also raise the overall personal income tax exemption level by Rs 1 lakh to Rs 5 lakh.

Advertisement

)

End of Article