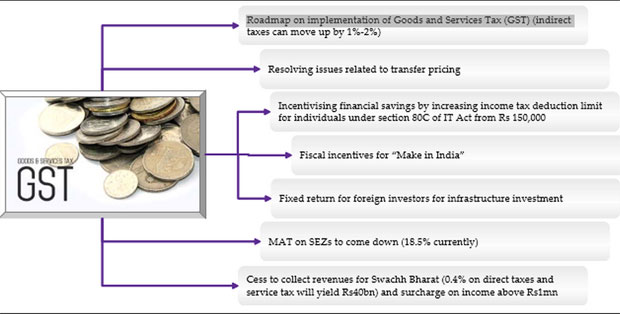

For the finance minister to balance fiscal consolidation and boosting growth, the government will have to initiate far reaching changes on the taxation front including ensuring a non-adversarial tax regime, steps towards GST and benefits on personal tax. [caption id=“attachment_2116493” align=“aligncenter” width=“620”]

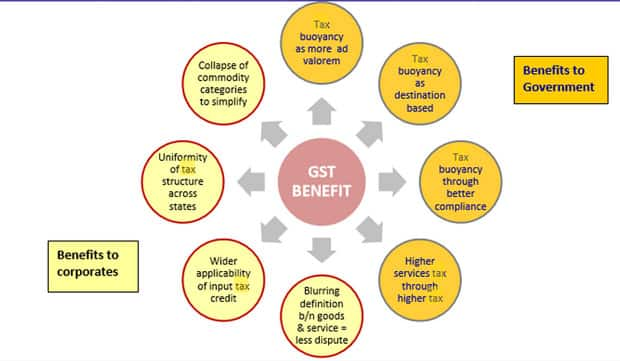

Source: IDFC Securities[/caption] The government has articulated its vision of ensuring a non-adversarial tax regime and end ‘tax terrorism’. For example it accepted the order of Bombay High Court in the case of Vodafone Indi, which is expected to reduce litigation on similar issues and put to rest the “uncertainty prevailing in the minds of foreign investors and taxpayers in respect of possible transfer pricing adjustments on transactions related to issuance of shares, and thereby improve investment climate in the country”, said brokerage Motilal Oswal in a report. Secondly, the government has barred tax officials to issues summons to senior management of large companies except when there are indications of their involvement in a decision making process. . Thirdly, the constitutional amendment bill for introduction of Goods and Services Tax (GST) has already been introduced in the Lok Sabha. While most of the design and implementation issues are still being evolved, it is evident from the scope of the constitutional amendment bill that GST would bring significant benefit to corporates and the government. [caption id=“attachment_2116499” align=“aligncenter” width=“620”]

Source: IDFC Securities[/caption] The government has articulated its vision of ensuring a non-adversarial tax regime and end ‘tax terrorism’. For example it accepted the order of Bombay High Court in the case of Vodafone Indi, which is expected to reduce litigation on similar issues and put to rest the “uncertainty prevailing in the minds of foreign investors and taxpayers in respect of possible transfer pricing adjustments on transactions related to issuance of shares, and thereby improve investment climate in the country”, said brokerage Motilal Oswal in a report. Secondly, the government has barred tax officials to issues summons to senior management of large companies except when there are indications of their involvement in a decision making process. . Thirdly, the constitutional amendment bill for introduction of Goods and Services Tax (GST) has already been introduced in the Lok Sabha. While most of the design and implementation issues are still being evolved, it is evident from the scope of the constitutional amendment bill that GST would bring significant benefit to corporates and the government. [caption id=“attachment_2116499” align=“aligncenter” width=“620”]

Source: Motilal Oswal[/caption]

Source: Motilal Oswal[/caption]

Budget 2015: These graphics explains what can be done on the tax front

FP Staff

• February 23, 2015, 16:16:27 IST

For the finance minister to balance fiscal consolidation and boosting growth, the government will have to initiate far reaching changes on the taxation front including ensuring a non-adversarial tax regime, steps towards GST and benefits on personal tax.

Advertisement

)

End of Article