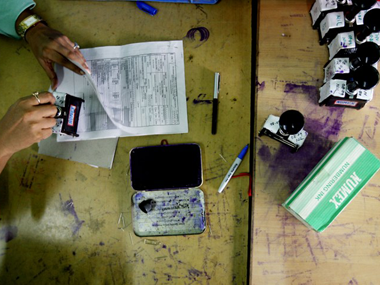

In a stern warning to to tax evaders, the income tax department has said over 12 lakh permanent account holders have not filed income tax returns. While urging taxpayers to disclose their true income, the Directorate of Intelligence and Criminal Investigation has sent letters to 35,170 PAN holders containing their high value financial transactions detected through the hi-tech 360 degree profiling exercise. [caption id=“attachment_621955” align=“alignleft” width=“380”] AFP[/caption] The high priority cases for action have been identified on the basis of specific 148 codes of information available in annual information returns (AIRs), central information branch (CIB) data and TDS/TCS returns. The exercise also takes into account the cash transaction reports (CTS) of financial intelligence unit (FIU)-India. The department said that it has identified “target segment of 12,19,832 non-filers linked to more than 4.7 crore information records. Rule base algorithms have been used to identify high priority cases for follow-up and monitoring”. The letters which have been sent to 35,170 PAN holders contain summary of information about financial transactions along with customised response sheet with a view to know why the person has not filed the income tax return. Revenue secretary Sumit Bose earlier in December had warned that there was no advantage of suppressing the true income or avoiding payment of income tax as “sooner or later, the information available with the income tax department will lead the department to the doors of such persons.” Finance minister P Chidambaram had underlined the need for a non-intrusive tax administration to enable the taxpayer to file return and pay appropriate taxes, the release said, appealing to tax payers to disclose their true income and pay taxes accordingly within the current financial year. PTI

AFP[/caption] The high priority cases for action have been identified on the basis of specific 148 codes of information available in annual information returns (AIRs), central information branch (CIB) data and TDS/TCS returns. The exercise also takes into account the cash transaction reports (CTS) of financial intelligence unit (FIU)-India. The department said that it has identified “target segment of 12,19,832 non-filers linked to more than 4.7 crore information records. Rule base algorithms have been used to identify high priority cases for follow-up and monitoring”. The letters which have been sent to 35,170 PAN holders contain summary of information about financial transactions along with customised response sheet with a view to know why the person has not filed the income tax return. Revenue secretary Sumit Bose earlier in December had warned that there was no advantage of suppressing the true income or avoiding payment of income tax as “sooner or later, the information available with the income tax department will lead the department to the doors of such persons.” Finance minister P Chidambaram had underlined the need for a non-intrusive tax administration to enable the taxpayer to file return and pay appropriate taxes, the release said, appealing to tax payers to disclose their true income and pay taxes accordingly within the current financial year. PTI

Chidu targets 12 lakh PAN holders for not filing returns

FP Archives

• February 12, 2013, 10:29:25 IST

Directorate of Intelligence and Criminal Investigation has sent letters to 35,170 PAN holders containing their high value financial transactions detected through the hi-tech 360 degree profiling exercise.

Advertisement

)