The problem for bulls in the current market is that all the good news has already been discounted. From interest rates to a good budget, the Sensex is doing the high-wire act because the markets have already assumed good things from P Chidambaram, whether it is in terms of the fiscal deficit or reforms or rate cuts. In short, the best is already over.

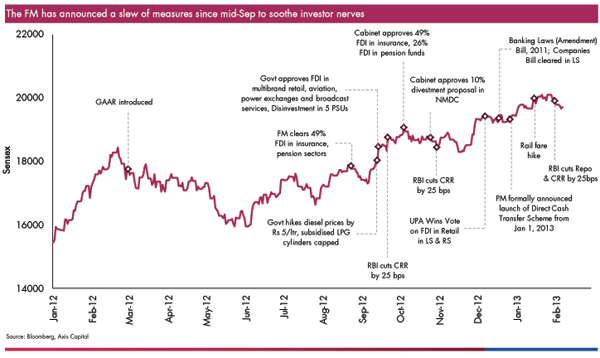

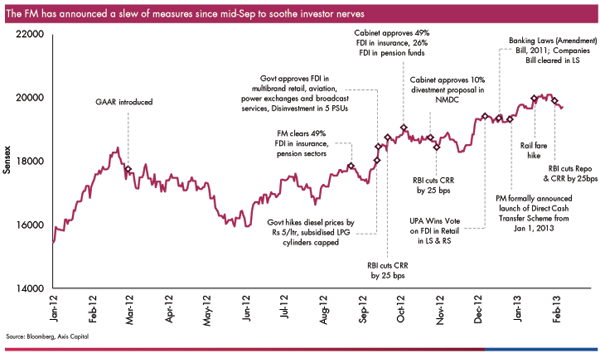

Even a report by Axis Capital points out that the FM has already stolen his own thunder by announcing a slew of measures outside the budget. The announcements resulted in the Sensex topping 20,000 and reaching its 2013 high, after which it has only been consolidating as all the good news seems to have been priced in by the markets.

“Focus will now be on Stability, Credibility on fiscal consolidation and Reform intent in order to reposition India as an attractive investment destination,” the report says.

See the chart below to understand why the Budget will be a non-event

[caption id=“attachment_622494” align=“alignleft” width=“600”] Budget Day isn’t important. Managing the budget after Budget Day is crucial. Chart by Axis Capital[/caption]

Budget Day isn’t important. Managing the budget after Budget Day is crucial. Chart by Axis Capital[/caption]

But as the RBI’s recent monetary policy shows, the real challenges lie ahead.

The current account deficit is likely to get worse in the third quarter, and if the fourth quarter does not show significant improvement, the RBI will again have to be cautious on rate cuts.

Since the government has to raise revenues for election-year giveaways, this means either indirect or direct taxes have to be raised. Either way, the budget will bring some kind of bad news for the corporate sector. In the alternative, if Chidambaram shows funny numbers of a lower fiscal deficit without actually increasing taxes or cutting expenses-as his predecessor did-the markets will see through his jugglery and push the indices down. The pre-budget bounce is thus a good time to lock into stock gains. After the budget, all bets are off.

)