[caption id=“attachment_101708” align=“alignleft” width=“380” caption=“f a PSU cannot grow its balance-sheet, odds are the problem lies within. Reuters”]

[/caption]

[/caption]

The discussion about State Bank of India (SBI) has treated one proposition as a given: that it is the job of the ministry of finance to continually inject capital into SBI so as to enable the growth of the SBI balance-sheet; that SBI has a legitimate claim upon fiscal resources at all times.

I’m not sure this is a good way to think about the business of banking. The first task of a bank should be to produce adequate retained earnings so as to support the desired growth. If a bank cannot produce retained earnings enough to grow, there is reason for thinking that it should not grow.

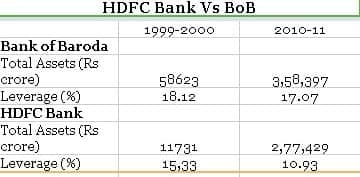

Let’s compare the performance of the best private bank ( HDFC Bank ) and a good public sector bank ( Bank of Baroda ) from this perspective.

Growth of the balance sheet and leverage

Let’s look at how the two banks have fared, from 1999-2000 onwards, on the core issues of balance-sheet growth and leverage:

[caption id=“attachment_101667” align=“alignleft” width=“360” caption=“HDFC vs BoB”]

[/caption]

[/caption]

From 1999-2000 to 2010-11, there has been a sharply superior performance by HDFC Bank. At the start, it was a small bank - with a balance-sheet of just Rs 11,731 crore while BoB was roughly five times bigger. By the end, HDFC Bank was at a balance-sheet size of Rs 277,429 crore while BoB was at Rs 358,397 crore.

What is more, HDFC Bank did this while being more prudent: they deleveraged in this period: They went from a leverage ratio of 15.33 to a leverage ratio of 10.93. In contrast, BoB stayed at a much higher leverage (18.12 at the start and 17.07 at the end).

The bottomline: BOB grew net worth by 6.5 times and the balance-sheet by 6.11 times. HDFC Bank grew net worth by 33.17 times and the balance- sheet by 23.65 times.

In the naive intuition that’s being bandied about in the discussion about SBI, there would be an expectation that the expansion of net worth would be obtained by asking shareholders (new or existing) for money. What happened in HDFC Bank and BoB was a bit different.

The hallmark of a healthy bank is the production of retained earnings which can be ploughed back into the business. HDFC Bank did that: over this period, it brought 13.23% of total assets (summing across the 12 years) back into the business, so as to grow net worth. BoB did not do as well: it brought only 7.86% of total assets back into the business.

In addition, HDFC Bank raised 13.66% of total assets by bringing in fresh capital. BoB, in contrast, brought in only 2.11% of total assets into the business. You could criticise the ministry of finance for being niggardly in giving BOB equity capital.

Summary

A well-run bank must put retained earnings back to work. If a bank is unable to fund its own growth by increasing net worth through retained earnings, there is reason to be concerned about the health of the core business.

A steady flow of new capital from shareholders, in order to enable growth, is not that different from recapitalisation in response to bad assets.

Public money is precious. The ministry of finance would do well to be very, very stingy in doling out public money to public sector banks. Each Rs 5,000 crore that goes into a PSU comes at an opportunity cost of 1000 km of NHAI highways which could have been built using that money.

If a PSU cannot grow its balance-sheet, odds are the problem lies within: it needs to become a better run business and thus grow the balance-sheet using retained earnings. Such PSUs are precisely the ones who are the least deserving to gain fresh capital.

If anything, fresh capital should be directed into banks like HDFC Bank (as the private capital markets have), who are doing a great job of producing retained earnings.

Read more on Ajay Shah’s blog .

Ajay Shah studied at IIT, Bombay and USC, Los Angeles. He has held positions at the Centre for Monitoring Indian Economy, Indira Gandhi Institute for Development Research and the Ministry of Finance, and now works at NIPFP where he co-leads the NIPFP-DEA Research Programme. His research interests include policy issues on Indian economic growth, open economy macroeconomics, public finance, financial economics and pensions. ajayshah@mayin.org</a> http://www.mayin.org/ajayshah</a> http://ajayshahblog.blogspot.com</a>

)