Blogs News - Page 19

Subbarao's subtext: Govt is the real threat to economy

Government deficits are the ever-present threats to growth. This is the underlying message in the third quarter monetary policy review

CRR cut: Govt plays spoilsport to more robust market rally

The RBI could have offered a repo rate cut if only the government had achieved some measure of fiscal consolidation.

Subbarao faces tight balancing act on interest rates

The RBI boss, who will unveil a review of Monetary Policy on 24 January, has a tough tightrope walk to execute this time.

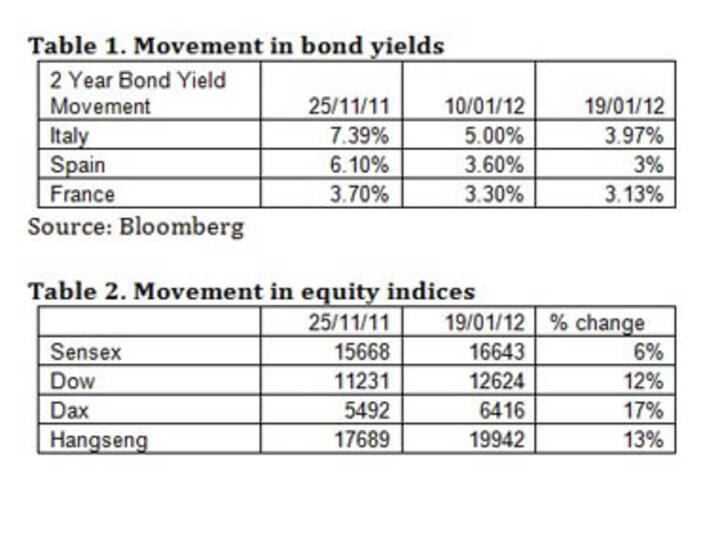

The euro debt crisis isn't over; it's the ECB opening the taps

Yields on eurozone debt have fallen, but don't assume that the crisis is abating. This is just the result of the ECB's liquidity boosting activities.

Rs 65,000 cr missing money: RBI needs to explain liquidity drop

Even after accounting for dollar sales, and extra note printing on the govt's behalf, there is a Rs 65,000 gap in unexplained liquidity demand.

FM claws back policy space from SC in Voda: 2G next?

Pranab Mukherjee made it very clear that making policy was government's right, not courts. Does this mean it will make its own 2G auction policy?

M&A, PE deal values shrink in April; healthcare tops list

Volumes remain robust, but valuation concerns see deal sizes going down.<br /><br />

Relax, things are not as bad as doomsdayers claim

India's poor run will stop sooner than later and it will be despite the government. Take, for example, the IT sector. Infosys and Cognizant have guided for slower growth this year, but the fact is that their hiring plans are still robust with each of them planning to up the workforce by over 20 percent.

How to get telcos to pipe down: revenue share auctions

India's telecom sector is screaming blue murder over Trai's spectrum pricing. Maybe they should bid in terms of revenue share.

Indian tech enterprise is thriving; LinkedIn told us why

The sale of SlideShare to LinkedIn for $119 million shows Indian tech entrepreneurs are increasingly powering global organisations.

Why Indians will keep buying gold even at higher prices

Rise in gold prices is a catch-22 situation. Rising gold prices will increase gold imports despite a duty hike and higher gold imports will push up the CAD further, which will weaken the rupee, and the falling rupee will lead to a rise in gold prices.

Why the rupee's ride may only get rougher from now on

The April-December trade figures show why the rupee is not going to be out of the woods for some time yet.

Delhi airport hike: precedent that will be closely watched

How should tariffs be set for natural monopolies like airports? The recent tariff hike for Delhi airport will be closely watched

The RBI should not wait; it must cut CRR and rates now

Since the economy always responds with a lag to rate cuts, the RBI needs to start cutting repo and CRr rates in its 24 January policy

Govt may consider issue of $ bonds as in the late 1990s

Given the sharp fall in dollar inflows, the government could consider the issue of external bonds like the IMD and Resurgent India Bonds of the 1990s

2012 will be a year of austerity for India - so be prepared

Debt reduction and lower consumption will be the watchwords for India. This is good for the markets in the long run. Look for a revival by the second half of 2012.

If you are in a commodity market, it's your fault

Clearly there are no innovative categories or innovative brands. Just innovative people.

The wages of slowdown: Govt's coffers are running dry

The government is facing a Rs 80,000 crore shortfall in tax and non-tax receipts this year. It is scrounging around for cash.

Subbarao to play Santa 2 weeks late; CRR cut in early Jan?

Given extremely tight liquidity conditions and soaring short-term rates, the RBI has no option by to ease liquidity by cutting the cash reserve ratio.

Sodexos for middle class? They may work better for the poor

Urban middle class taxpayers use Sodexo coupons to buy food from malls. These coupons may be better for food security or NREGA payments to the poor.

Is Maximum City scary and impossible to live in?

Bollywood style icon Sonam Kapoor tweeted that it's almost impossible to stay in Mumbai. While Thomas Swick writes that no other city had scared him, even before he visited it, like Mumbai did.

Why should you feel guilty when you quit your job?

It's not the most pleasant option for either side, but life moves on. You get a new job, the employer gets a new replacement.

PSUs are not for shareholders, so why invest in them?

Minority shareholders do not figure in the government's scheme of things except to buy out a part of its ownership when the government disinvests a small stake.

Do you remember the original business purpose?

Many businesses that start with the passion of an individual rather quickly find themselves in areas of associated businesses that are not necessarily related to the original purpose.

Why RBI's gaze will shift from prices to rupee and liquidity

With inflation showing signs of easing, the RBI will have to focus on liquidity and guide the markets on the rupee's future direction.

Going up, up, up: Food prices, airfares, mobile tariffs

Whoever said inflation was softening ought to have his eyes examined. Newspaper headlines are confirming this every day.

Business cycle effect: Why our growth will be volatile

Bad policy may be lowering the Indian economy's trend rate of growth, but the business cycle will give us more volatility in GDP growth.

The blue tarpaulin: what it bares about Mumbai's high-rises

The city's architecture defies climate. For Mumbai's high-rises, the need to be tower-like, an icon splashed on front page ads of national newspapers, is the problem.

Here's currency and bond market response to EU: 'Yawn'

The European Union's decision to reduce deficits is not really a solution to the eurozone crisis. The stock markets may be happy, but the bond and currency markets know better

Should you bet on equities or commodities in medium term?

Trend of outperformance of equities led by knowledge stocks will continue going forward given the positive outlook for the US economy, as well as given the weak growth outlook for China and India