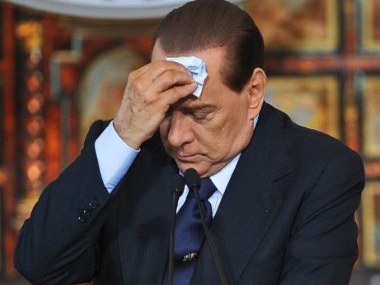

After Greece, Italy is next on the hook with global investors. On Monday, the cost of borrowing for the Italian government hit a new record as fears mounted over political turmoil in Rome. The yield on 10-year government bonds hit 6.71 percent – the highest since the country joined the eurozone in 2001 and perilously close to the bond yield levels at which Portugal and Ireland needed financial bailouts. So what’s going on? Here are five things you need to know about the country right now. Fact 1: Italy has always had high levels of public debt. Its public debt-to GDP ratio has been above 100 since the 1990s. But unlike Greece, it is actually financially sensible. The government actually spends less on providing services and benefits to its people than it earns in taxes, and has been doing so every year since 1992, except for the recession year of 2009, according to the BBC. [caption id=“attachment_126083” align=“alignleft” width=“380” caption=“Italy’s Prime Minister Silvio Berlusconi. AFP”]  [/caption] The only reason why Italy borrows is to meet its principal and interest payments on existing debts. Nevertheless, the country’s absolute level of debt is staggeringly high – more than $2.5 trillion and estimated to touch 120 percent of GDP this year. Fact 2: Bond yields have surged because investors are worried that a persistently weak economy – it has seen zero-to-low growth in the past two decades – will not be able to support high interest payments in the future. Bond yields, a measure of what a government requires to rollover its debt, tell us how investors view the health of an economy. During good times, when money is expected to be paid back, yields tend to remain low. But during difficult times, they can soar because creditors demand a “risk premium” (an extra rate over what is normally charged for economically stable borrowers) to compensate for the higher risk that the money might not be repaid. Surging yields already imply an extra 7.6 billion euros in debt payments for Italy, according to one expert in the UK’s Telegraph newspaper_._ Meanwhile, Italy’s growth in the past decade has averaged 0.8 percent a year, which means that government revenues are not even in a state to cover interest payments, noted a seekingalpha.com report_._ Fact 3: Italy is the third-largest economy in the eurozone. A bailout will severely stretch the resources of the eurozone and the International Monetary Fund. The eurozone’s bailout fund — the European Financial and Stability Facility – was enlarged to one trillion euros to support countries like Italy and it feels increasingly like it will, indeed, become the next victim of the eurozone sovereign debt crisis. This could be the one to bring the eurozone crashing down. Fact 4: Its bonds are widely held by foreign investors, which means that if the country defaults, there’s a much larger knock-on effect in financial markets. Europe’s 20 biggest banks hold 186 billion euros of Italian sovereign debt, led by Intesa SanPaolo, Unicredit, BNP Paribas, Dexia, Commerzbank and Credit Agricole, according to a report in the Telegraph. Even a whiff of default could trigger a collapse of confidence in financial markets about other indebted governments and lead to an exodus of capital. Fact 5: The biggest factor weighing down markets about Italy is, in fact, not economics but politics. The awash-in-scandals government of Prime Minister Silvio Berlusconi is fuelling doubts about whether the country has the political will to push through tough austerity measures to cut back government spending and increase taxes. At the moment, there are doubts whether his government will even survive the near term. If Berlusconi resigns and a new unity government is ushered in, chances are confidence could return to the markets. Financially, Spain is in a much worse position, according to some commentators. At least Italy is not running a particularly large budget deficit (currently 4 percent of GDP) compared with Spain, which had a more than 9 percent deficit at one point, said Franco Pavoncello, a political scientist at Rome’s John Cabot University in Time magazine. “What drives the cost of Italian bonds is simply a question of politics. Markets go where they see weakness. And today they see weakness in Italy.” [1 euro=1.37 USD]

After Greece, Italy is next on the hook with global investors. On Monday, the cost of borrowing for the Italian government hit a new record as fears mounted over political turmoil in Rome.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)