New York: President Barack Obama badly needs economic gains to get back his mojo. A boost to the economy in the shape of Fed action and knock-on market rally will naturally support Obama’s re-election. Currently, Obama’s numbers are driven by the sluggish economy.

A Gallup poll released on 8 August had Obama and his Republican rival Mitt Romney running neck-and-neck with Obama at 47 percent and Romney at 46 percent. Those who strongly disapprove of Obama’s handling of the economy vastly outnumber those who strongly approve.

The US economy has shown modest improvement in recent weeks, but analysts don’t expect growth to accelerate much. Some economists say growth may improve to an annual rate near two percent in the July-September quarter.

Will Bernanke do the trick?

As the presidential election draws near and the US economy retains the spotlight, some say moves by the Fed so close to November could be seen as carrying a political tinge, favouring one candidate over the other.

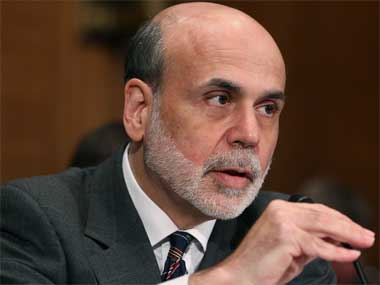

[caption id=“attachment_430051” align=“alignleft” width=“380”]  Investor sentiment received a fillip after US Federal Reserve Chairman Ben Bernanke, said there is room for more action on the part of the Fed to shore up growth. Getty Images[/caption]

The Fed of course, much like The Reserve Bank of India, stays out of the political fray. Since the late 1970s, the Fed’s statutory mandate has called for it to “promote effectively the goals of maximum employment, stable prices, and moderate long term interest rates.”

Impact Shorts

More ShortsStill, the Fed could make or break things for Obama. Witness Friday’s market action: The Dow Jones Industrial Average banked its first triple-digit gain in three weeks on Friday on expectations that the Federal Reserve stands ready to give adrenalin shots to the economy. The Dow added 100.51 points, or 0.8%, to 13157.97, rising for the first time this week.

Investor sentiment received a fillip after US Federal Reserve Chairman Ben Bernanke, said there is room for more action on the part of the Fed to shore up growth. Bernanke made the comment in a letter to a Congressional oversight panel.

“There is scope for further action by the Federal Reserve to ease financial conditions and strengthen the recovery,” Bernanke said in a letter dated 22 August to California Republican Darrell Issa.

The Fed has kept interest rates near zero for several years, and has said it plans to keep them there through the end of 2014. However, with rates already as low as they can go, the Fed has also embarked on innovative ways of pumping up the economy, most notably via two rounds of bond purchases known as “quantitative easing.”

Bernanke said previous stimulus including the two rounds of quantitative easing in which the Fed purchased $2.3 trillion of securities have “helped to promote a stronger recovery than otherwise would have occurred, and to forestall the possibility of a slide into deflation.”

Bernanke also noted in his letter that the Fed’s recent decision to extend a project known as “Operation Twist,” which has the Fed reorienting its portfolio in a bid to lower borrowing costs, is still “working its way through the economic system.”

Will he or won’t he?

Investors have been looking for clues all week about what the Fed plans to do. They don’t really expect Bernanke to reveal specific new measures at the central bank’s annual symposium next Friday in Jackson Hole, Wyoming, but minutes from the Fed’s last meeting released earlier this week suggested the Fed was leaning toward launching a third round of quantitative easing, or QE3.

“With Bernanke set to speak, people are feeling QE-ish,” David Lutz, a managing director at Stifel Nicolaus in Baltimore, told The Wall Street Journal.

In previous years Bernanke has used this economic symposium to float new policy ideas and test the waters for market reaction.

)

)

)

)

)

)

)

)

)