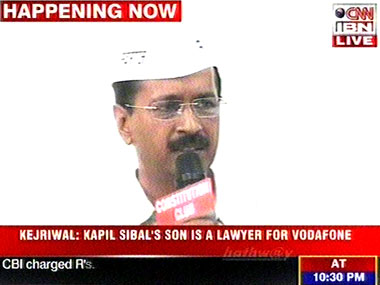

Aam Aadmi Party (AAP) has alleged conflict of interest in newly appointed Law Minister Kapil Sibal’s decision to allow an out-of-court settlement of Vodafone tax evasion issue. Kabil Sibal extended undue favours to the telecom company because the Law Minister’s son Amit Sibal represented it in court alleged Arvind Kejriwal. “Sibal’s go ahead for conciliation is significant especially in view of the fact that the main company in this case — Hutchinson Telecommunications International Ltd — is his son Amit Sibal’s client,” said AAP founder Kejriwal. [caption id=“attachment_784857” align=“alignleft” width=“380”]  Arvind Kejriwal holds a press conference in New Delhi on Wednesday. Ibnlive[/caption] “This is amazing. One Law Minister resigns over corruption charges. The other person takes over and within a day, starts working in favour of the private firm,” he added. AAP members produced before the media an agreement between Hutchinson and Essar, under which the former paid Rs 2,000 crore to Essar to all court matters all withdrawn. “Was part of this Rs 2,000 crore given to Kapil Sibal?” asked AAP member Prashant Bhushan, demanding to know what is unique about the company because of which the Law Minister went out of his way to help it. Sibal, who got the additional charge of the law ministry after Ashwin Kumar’s resignation, gave the go-ahead for an out-of-court settlement of the Vodafone issue. He overturned the decision of his predecessor, Kumar, who had rejected the Finance Ministry’s proposal for conciliation terming it ‘illegal’. Attorney General GE Vahanvati had also advised against conciliation with the British telecom giant. But after Sibal cleared the deck for conciliation and sought Vahanvati’s opinion on the same, the latter favoured it. Vahanvati said his fresh opinion was based on the clarification given by Finance Minister P Chidambaram during his meeting with the Revenue Secretary and the Chairperson of the Central Board of Direct Taxes (CBDT). In the meeting, Chidambaram said that the conciliation proposal would not bypass or alter the tax liability under the Income Tax Act. “Chidambaram further clarified, according to Vahanvati, that the permission of the Cabinet was being sought for a non-binding conciliation only to discuss issues with Vodafone and has assured that no contract would be signed outside the provisions of the law,” NDTV reported on Tuesday. After the Cabinet approval, the proposal will go through Parliament ratification. “You have to understand that this is a demand raised by a budgetary provision and cannot be overridden by an executive order,” Economic Times quoted Sibal saying on Tuesday. “Anything that is decided will ultimately have to go to Parliament. Any out-of-court settlement/conciliation through any non-formal process would have to be first brought before the Cabinet,” Sibal added. British telecom major Vodafone faces over Rs 11,000 crore tax liability in India for purchase of Hong Kong-based Hutchison Whampoa’s stake in Indian telecom business Hutchison Essar in 2007. However, Essar has denied any allegations of wrongdoing. The company issued a statement saying, “The agreement relates to a settlement of commercial disputes with Hutchison in 2007. Essar, as a minority joint venture partner, had claimed certain pre-emptive rights in respect of the sale of Hutchison’s shareholding in Hutchison Essar Ltd. (HEL) Under this agreement, Essar agreed to withdraw its objections to the proposed sale of Hutchison’s interests in HEL to Vodafone plc. Essar sold its entire shareholding in Vodafone Essar Ltd in 2011-12 and does not have any continuing interest in the company.”

“Sibal’s go ahead for conciliation is significant especially in view of the fact that the main company in this case — Hutchinson Telecommunications International Ltd — is his son Amit Sibal’s client,” said AAP founder Kejriwal.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)