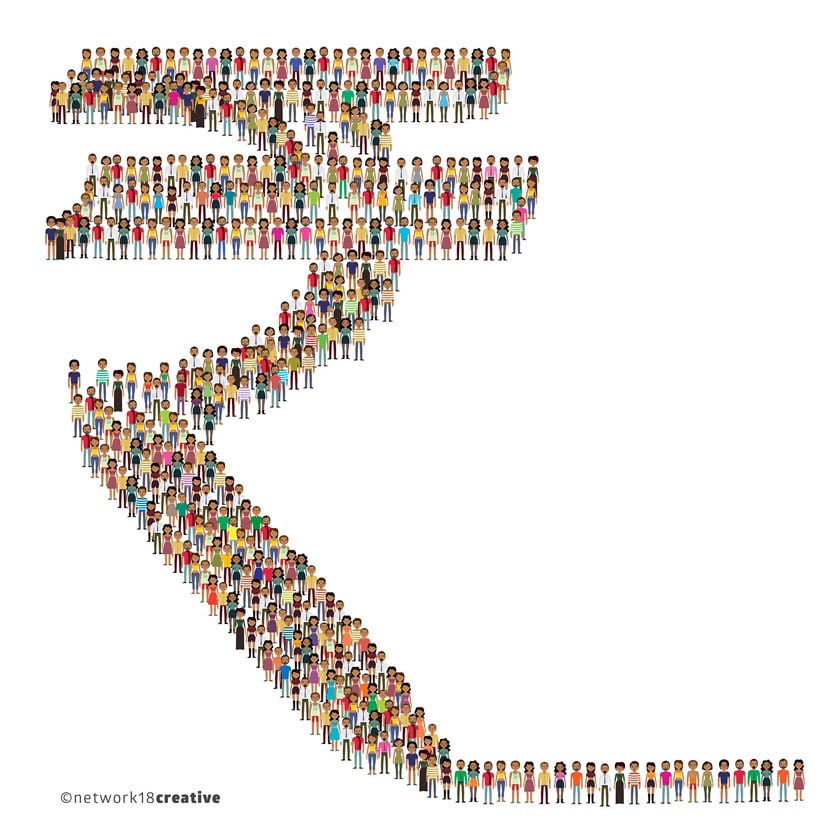

There is praise and criticism for Narendra Modi’s Tuesday night crackdown on Rs 500 and Rs 1000 notes. On Tuesday, around 9’o clock, when the world was still closely engaged in the Donald Trump-Hillary Clinton duel, the headlines changed in India soon after PM Modi appeared on national television saying forget your Rs 500, Rs 1000 bills post-midnight. The government did so as part of a plan to flush out fake currency from the system, reduce black money and address the issue of terror funding. There are two ways to look at the currency crackdown announced by the Prime Minister on that evening. [caption id=“attachment_3096046” align=“alignleft” width=“380”]  Representational image. PTI[/caption] One, you can write-off the entire exercise as futile one and a counterproductive move hurting the common man, who still lives in a cash economy. The proponents of this school of thought would tell you the following aspects to cement their arguments: 1. Black money is too big an animal to be tamed with a single exercise as the current one taken by the Modi government. Illegal hoarders of black money do not sit on cash piles, but would have parked their ill-gotten wealth in gold, real estate, benami layers and dollar assets already. Hence it is foolish to imagine that the entire lot of black money will be wiped out of the system with Modi’s announcement. The size of black money in the economy is huge, they would say. Of the total cash stock of $240 billion (going by RBI numbers), a sizeable chunk is used as vehicles by black money holders. The current exercise will only touch a fraction of what we call as black money, they would say. 2. Those who possess black money can still circumvent the wall set up by the government to whiten their unaccounted cash. They can pack their pile into small bundles and send people to different banks to get it exchanged for legitimate currency notes. There will be mediators who would be specializing on this operation, who could save the trouble for their clients for a commission. 3. The new stock of black money will come up in no time as soon as the government releases new notes in the market (Rs 2,000 notes have already come, Rs 500, Rs 1,000 are on the way). So what’s the point in replacing old currency notes with a new set? Why can’t the government push the population to use plastic currency straight away? Aren’t they replacing one problem with the other, they would ask. The second group — the supporters of the currency crackdown – would look at Modi’s currency move as significant and counter the above arguments in the following manner. 1. Yes, black money is too big a rogue animal to tame with a single blow. But, you need to begin taming the animal at some point right? You should send a strong message to the beast that every time it contemplates to attack its companions in the cage or refuse to abide by the trainer’s instructions, it will get beaten up, severely. Till now, there has been no substantial efforts to tame this creature — either the earlier trainers wanted to befriend the beast and let it live the way it wanted to or were too scared to confront. [caption id=“attachment_3101304” align=“alignleft” width=“825”]  Courtesy Network18 Creative [/caption] Presently, Rs 500 and Rs 1,000 notes constitute 86 percentage of the total currency in circulation, in terms of value. Hence, logically much of the black money in the cash economy would have been parked in these denominations. Flushing out the old stock will help to address at least part of the problem, if not in entirety. As the next step, the government can press the IT sleuths into service to track down benami assets and illegal holdings in gold and real estate. This exercise will be difficult, but not impossible if there is political will. 2. True, part of the black money will come back to the system as illegal cash holders can split the amount into small packets and get it deposited/ exchanged in various accounts. But, remember, this exercise isn’t going to be smooth for the crooks for a variety of reasons. The logical question is how much of this can they carry out. Imagine someone has Rs 10 crore black money and wants to whiten it using the window given by the government at banks and post offices. He will have to split it into 400 small parts of Rs 2.5 lakh if he needs to avoid tax. If he makes it into bigger lots, then he will have to pay 200 percent penalty on every lot, which takes away the purpose of the tax evaders. Now, if he decides to stick to the government limit of depositing cash upto Rs 2.5 lakh to save himself of tax-trouble, the taxmen would have to be a group of dumb men to ignore 400 transactions that will leave some pattern. Remember, every high value transaction will need PAN number and identity proof. Mr Tax Evader should be very lucky to escape the taxman’s attention if he needs to do it before 30 December, 2016. Post that, there will be tighter scrutiny. 3. Yes, counterfeit machines will start rolling again once the ingenious get samples of the new notes. They will strive to make even better quality notes keeping in mind the larger public interest. This can come in anytime now. But, that’s an inevitable challenge the government will have to deal with. Till the time civilizations last, there will be crooks and conmen around. That is not the excuse for not doing a clean-up exercise on the existing lot of fake currency network. The fact remains that majority of India still continues to be heavily dependent on cash for daily life. Only a small fraction of the population in metros have migrated to a non-cash living. Even there, the milkman, the newspaper_wallah_ and the vegetable vendor will need cash. In this context, not replacing the currency sucked out of the system (that too given the chunk constitutes 86 percent of the total value) is an unthinkable act. It will only cripple public life. There are other consequences to this act too, but albeit positive. The currency crackdown and turning illegal cash/fake currency to paper overnight will have positive impact on inflation, real estate prices and better monetary transmission in the economy too. The benefits of such a crackdown far outweighs the near-term pain caused to the public and transition issues. Without doubt, this is a major step in attacking the parallel economy and perhaps the most effective step in this direction India has seen since in 1978. The point here is this: What Modi has done is an unpopular act, for sure. Among the aam aadmi, this wouldn’t be of much help to Modi to win votes. The currency crackdown is only a step among the many the government still needs to take to destroy the parallel economy that has thrived in India for decades. It also breaks the back of the political funding mafia and real estate black money lobby. If someone has strong evidence that the government leaked the operation plan to interested-parties in advance enabling them to take precautions well in advance, they should point fingers at the Modi government. But, questioning the very efficiency of the currency crackdown either shows their ignorance or bias. That is not productive criticism. By far, this is the boldest financial sector reform this government has undertaken so far. Over to critics.

You can write-off the entire exercise as futile one and a counterproductive move hurting the common man, who still lives in a cash economy.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)