By VS Fernando

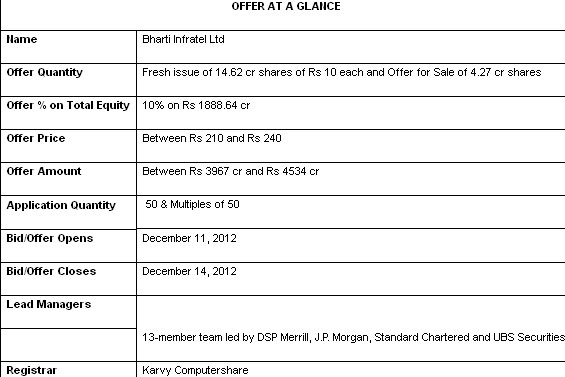

Even though the Bharti Infratel issue has been fully subscribed a day ahead of its closure, the equity offered through the IPO amounts to just 10% of the company’s post-issue capital of Rs 1888.64 crore. Interestingly the company’s issue advertisement misreads the post-issue capital as “more than Rs 40,000 million”! So much so is the accountability of the 13-member book running lead manager-team towards the investing public!

[caption id=“attachment_556119” align=“alignleft” width=“565”]  The issue of 16.05 crore shares (excluding anchor portion), which closes on December 14, has received bids for 17.70 crore equity shares.[/caption]

Issue Object

The funds raised through the fresh issue (amounting to between Rs 3070 crore and Rs 3510 crore) are to be deployed as follows: Rs 1087 cr towards installation of 4,813 new towers; Rs 1214 cr on upgrading and replacement of existing towers; Rs 639 on green initiatives at tower sites and the balance for ‘general corporate purposes’.

Facts, figures and fiction that mar the reputation of India’s Telecom Czar

Bharti Infratel may have the distinction of floating the biggest IPO in two years. But, what about its disclosure-standard with regard to the history and track record of the promoter?

The offer document does not reveal more than the following:

“The promoter of the Company is Bharti Airtel. The Promoter currently holds 1,500,000,000 Equity Shares, constituting approximately 86.09% of the pre-Issue issued, subscribed and paid-up capital of the Company and will continue to hold a majority of the post-Issue paid-up share capital of the Company.

The Promoter is engaged in the business of providing telecommunication services. It offers mobile voice and data services, fixed line, high speed broadband, internet protocol television (IPTV), Digital TV services, ICT solutions for enterprises and national and international long distance services to carriers.

There has been no change in control or management of the Promoter in the last three years. The equity shares of the Promoter are presently listed on the BSE and the NSE.”

Do the management, investment bankers and market regulators think that the above disclosure is adequate and the history and track record of the promoter is not necessary in the offer document?

The over-confident merchant bankers argue that since Bharti Airtel is a listed company and its details are already in the public domain they did not deem fit to include in the issue prospectus. But, do the novices presently occupying the merchant bankers’ chairs know how many times did the promoters de-merge and re-arrange their businesses since they went public in 1986, and who benefited the most out of the perennial restructuring?

For starters, Bharti Airtel did not go public in its present format. The company was listed in the first quarter of 2002 under its previous avatar Bharti Tele-Ventures (BTV). As a holding company, BTV tapped the market in January/February 2002 in order to fund its subsidiaries Bharti Cellular and Bharti Mobile. BTV offered Rs 10 paid-up shares at a price of Rs 45 a piece. The company had the audacity to state in the offer document that it will not distribute any cash dividend and those who wanted dividends should not apply for the issue!

After going public, the promoters once again played the re-arrangement game. Major subsidiaries’ operations were merged with the public company, the name was changed and face value of the share was split from Rs 10 to Rs 5. Post-consolidation, the company’s market capitalization zoomed to over Rs 2,18,000 cr in 2007.

Though it reached its pinnacle through constant restructuring, the company could not sustain its position and the market cap started receding fast.

As if to arrest the downtrend, the management broke its own promise of not paying dividend and paid a maiden dividend of 20% in 2009. Since then it has maintained the dividend.

Bharti’s high standing in the telecom industry may be indisputable but, the group’s reputation is far from convincing to retain investors for long time.

Whereas companies like TCS, despite the IT slow down, has more than doubled its market cap (from Rs 1,10,000 cr to Rs 2,40,000 cr) in last five years, Bharti’s m-cap has crashed from Rs 2,18,000 cr to Rs 1,21,000 cr during the period. The uncertainties faced by the telecom sector may drag Bharti further in the foreseeable future.

Status and Future of Bharti Infratel an offshoot of Bharti Airtel

When the flagship Bharti Airtel’s prospects are sagging, its subsidiary Bharti Infratel (BIL) is now being used to raise funds.

Bharti Telecom Ltd(BTL) was formed in November 2006 with the main object of setting up, operating and maintaining wireless communication towers. As per a “Scheme of Arrangement” between Bharti Airtel and BIL the former transferred its “telecom infrastructure undertaking” to the latter in January 2008. Bharti Airtel currently holds 150 cr equity Shares, constituting approximately 86.09% of BIL’s pre-issue paid-up capital.

Meanwhile BIL entered into a joint venture agreement in December 2007 with Bharti’s competitors Vodafone India and Idea Cellular to form an independent tower company (“Indus Towers Limited”) to provide passive telecom infrastructure services in certain specified telecom circles. The subsidiary, Indus and some of the Group Companies are engaged in the business similar to that BIL.

Even while operating “Telecom Infrastructure” business on its own, BIL made a ‘Scheme of Arrangement’ for transfer of passive telecom infrastructure undertaking in 12 telecom circles to a 100% subsidiary, Bharti Infratel Ventures Ltd (BIVL) retrospectively from April 1, 2009, which was made effective in May 2011. Interestingly, on May 31, 2011, BIVL filed a scheme of merger before the Court whereby BIL’s subsidiary BIVL will merge with Indus Towers with effect from April 1, 2009! After this merger, what would be the equation between BIL and Indus Tower is not spelt out. When competitors and joint venture partners Vodafone and Idea have floated separate companies for passive telecom infrastructure, how secured is BIL’s future? The offer document does not throw any light on this.

Sagging business prospects

Besides the long term uncertainties BIL also faces some immediate problems. Notwithstanding the stringent penalty clause, the company may be unable to collect some or all of the termination fees from the telecommunications service providers who have terminated their co-locations as a result of cancellation of their 2G licenses pursuant to an order of the Supreme Court of India. The operations may also be affected by lower demand for new towers or co-locations at existing towers. Further, increasing competition in the tower industry and increasing tariff pressures on BIL’s and Indus’ customers may create pricing pressures that may adversely affect the company’s business, prospects, cash flows and financial condition.

Valuation

Conveniently BIL’s offer document claims that there were no listed companies in India that can be directly comparable to BIL and hence no comparison with industry peers. However, the fact is, there is a listed company, GTL Infra, whose performance is pathetic. BIL may not be comparable with GTL Infra but, can it be discounted more than its parent Bharti Airtel on whose prospects that the company is largely depending at present? Bharti Airtel is currently discounted about 20 times its earnings. Compared to this, BIL is priced more than 48 times its earnings even at the lower end of the price band.

[caption id=“attachment_556126” align=“alignleft” width=“533”]  Notwithstanding drummed up market-hype, promoters’ penchant for external funds, perennial restructuring of group entities, poor distribution record, corporate governance issues, steep pricing when industry is in dumps, the writer advises caution.[/caption]

Dividend Policy

The promoters who virtually dictated in 2002 that cash dividend-seekers should not apply for their issue have played tricky this time. BIL’s offer document reads: “During the quarter ended September 30, 2012, the company declared and paid ‘Interim Dividend’ for the financial year 2012-2013 at the rate of Rs 2.50 per equity share which includes Rs 1.50 per share aggregating to Rs 261.36 cr paid out of the accumulated profits earned up to March 2012 and Rs 1.00 per share aggregating to Rs174.24 cr paid out of the profits during the fiscal 2013.

Why should people who don’t believe in distributing cash dividend declare an unusual interim dividend and fleece the company to the tune of Rs 435 crore on the eve of the public issue? Well, by doing so, they have made it a dividend paying company without an obligation to pay full dividend to the public shareholders!

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on Firstpost are their own, and not that of the website or its management.

)

)

)

)

)

)

)

)

)