The clock is ticking for Suzlon Energy, which looks perilously close to defaulting on its foreign currency convertible bond (FCCB) payments.

The wind energy company has been facing a severe cash crunch brought on by a slump in the market and delayed payments from some big customers. It reported a loss of Rs 301.7 crore in the quarter ending December 2011 against a loss of Rs 253.57 in the same period a year earlier.

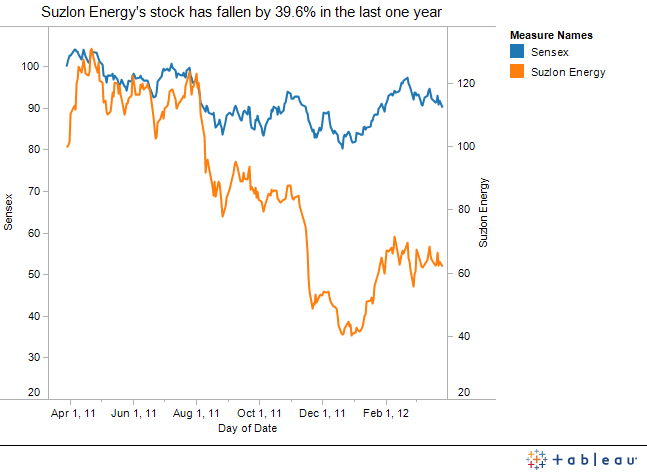

In a report, HSBC Global Research says it is bearish on Suzlon Energy and gives the shares a price target of Rs 20. Suzlon’s shares are currently trading at Rs 27.6 a piece.

The brokerage says Suzlon might not receive its due payments from US corporate client Edison Mission.

“While Suzlon now expects to receive the Edison Payment in the first half of the financial year 2013, we feel that it might not receive the $ 211 million payment from Edison by June 2012, when the first foreign currency convertible bonds (FCCB) repayment of $ 306 million (Rs 1,500 crore approximately) is due,” it notes in the report.

According to the report, Suzlon’s cash crunch is likely to be higher than expected: HSBC expects it to fall short by Rs 750 crore in June, when its first trance of FCCB payments is due. The company is expected to face a shortfall of Rs 3,000 crore in meeting its entire repayment obligations, the brokerage adds.

The company has also announced on the exchange today that its subsidiary RE Power Systems has signed a contract with PNE Wind AG to deliver 54 off-shore wind turbines.

HSBC expects the company’s net loss to be lower at Rs 253 crore for the year ending March 2012 compared to a loss of Rs 1,092 crore a year earlier.

)

)

)

)

)

)

)

)

)