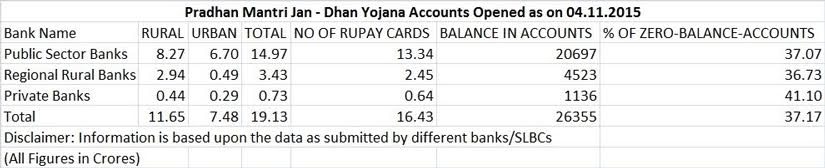

About 43 percent of the total bank accounts in India are dormant even though bank account penetration has surged in the country in the recent past, notes a World Bank-Gallup Global Findex Survey, quoted by the Indian Express. To be more specific, 195 million of the total 460 million dormant accounts around the world are in India. As a point of comparison, in high-income OECD economies, the dormancy rate is 5 percent, while globally 15 percent of the accounts are dormant accounts. [caption id=“attachment_2502476” align=“alignleft” width=“380”]  Reuters[/caption] Dormant accounts are those, where no transaction takes place either in the form of deposits and advances, or by way of any other electronic payments or purchases. “The sharp increase in penetration of accounts notwithstanding, the worrying aspect for India is that the country has among the highest rates of dormant accounts in the world,” the report says. The reason for such high rate of unused bank accounts in India, the report cites, is a large number of newly opened accounts under the Jan Dhan Yojana, the flagship scheme Prime Minister Narendra Modi launched in August 2014.  According to the government data, a total of 19.3 crore accounts have been opened under the scheme until 4 November, with total deposits mobilised about Rs 26,355 crore. Of this, currently 37 percent are zero-balance accounts. But, if one looks at the larger trend of zero-balance accounts since the time Jan Dhan was launched, the ratio of dead accounts is on the decline. In September 2014, nearly 77 percent of the accounts were dormant, while it has come down to 37 percent now with the roll-out of Direct Benefit Transfer (DBT) (check the decline in zero-balance accounts here.) LPG subsidy has already come under the DBT ambit. In the future, it will be used for distributing other subsidies such as food too. The point here is that if one looks at the trend in Jan Dhan accounts, the movement of dormant accounts isn’t really worrying, considering that the scheme has managed to bring down the number of unused accounts with the help of DBT, besides improving the deposit-mobilisation. The scheme has also been used to lay out a social security network by making insurance, pension products available through Jan Dhan accounts. Reason for dormant accounts As Firstpost has noted in the past, the problem was with the high-speed roll-out of the Jan Dhan. The state-run bankers were put at the gunpoint, which, they admit, forced them to distribute new zero-balance accounts to even those with existing bank accounts. Also, there was a rush from existing account holders to avail the benefits of overdraft, insurance and pension products offered by the scheme. In the process of meeting the targets, bankers also pointed out that they are unable to reach the needy segments often. Many experts, including Reserve Bank of India (RBI) governor Raghuram Rajan, had cautioned against the fast-paced implementation of the scheme. To push the programme and meet targets, it is quite possible that banks overlooked the know your customer (KYC) norms by permitting any document for the purpose of opening the account. In the absence of a single document (such as Aadhaar), chances of the same person opening multiple accounts using different documents are relatively high. This was highlighted by senior bankers who made a strong case for mandatory use of Aadhaar for opening accounts under Jan Dhan Yojana. Also, dormant accounts are indeed a concern for the banking system since there is a cost involved in maintaining such accounts. According to Indian Banks’ Association (IBA), the average cost for banks opening Jan Dhan accounts and maintaining them with benefits will be Rs 140 per account as against the earlier estimated Rs 80. Unless the central government compensates banks for this, banks will have to take a hit in terms of cost and time spent to maintain such accounts. But, there are no second thoughts on how critical is increasing bank account penetration for ushering in the poor and the unbanked in India’s far-flung villages into the world of formal finance. Jan Dhan accounts, coupled with, the roll-out of new set of payment banks and small finance banks are indeed a revolution that can change the way India’s poor banks in the long-term. Even now, a large section of the rural Indian population still depends the infamous private moneylender for her financial needs. Big role for small banks In the next stage, the most effective way to further take the Jan Dhjan process ahead is to push it through the new set of small banks. Considering their basic mandate (focusing on financial inclusion and serving the poor), these banks would happily chase the right customer in India’s unbanked villages to make the programme even a bigger success. Reach wouldn’t be an issue for these new set of banks since most of the small finance companies are microfinance companies, which are already present in every corner of the country and enjoy an existing client pool, even among unbanked citizens. The bottomline here is this: the reason for the sharp rise in bank accounts in India is that a significant number of the new bank accounts opened under the Jan Dhan programme are yet to be used by the new account holders. But, this problem will gradually subside as the DBT is rolled out for other subsidies and in other government schemes. Definitely, the long-term benefits of Jan Dhan accounts outweigh the present concerns over account of dead accounts.

The long-term benefits of Jan Dhan accounts outweigh the present concerns over dead accounts

Advertisement

End of Article

)

)

)

)

)

)

)

)

)