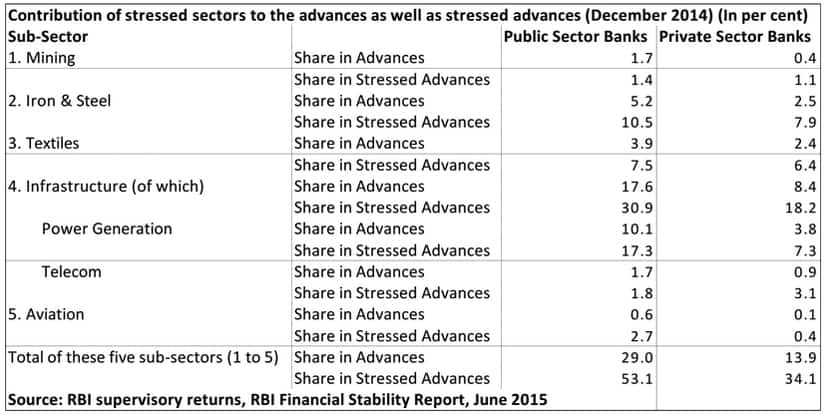

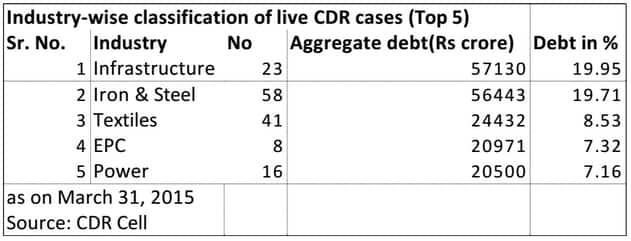

There is a clear warning from the Reserve Bank of India (RBI) to the North Block on the build up of stress on the balance sheet of Indian banks emerging from infrastructure loans. The financial stability report (FSR), released on Thursday, offers some critical insights into the depth of this problem. The numbers tell us two things: One, bad loans continue to be the head-ache of public-sector banks largely, much more than private or foreign banks. Second, there is a clear concentration risk developing from loans given to infrastructure companies. [caption id=“attachment_2286186” align=“alignleft” width=“380”]  Reuters[/caption] Finance minister, Arun Jaitley should be the one worried most about the infra-bubble developing on the books of state-run banks, for the simple reason that these banks, which make up for 70 percent of India’s Rs 95 lakh crore banking industry are at the mercy of the government for capital. Time and again, these banks have knocked the doors of the North Block with a begging bowl, an exercise they keep repeating every year. Before using the tax-payer’s money to recapitalise these banks, the government must realise where the pot is leaking. This is where the RBI report comes handy. The problem The RBI report shows that five sectors — mining, iron & steel, textiles, infrastructure and aviation — that together constitute 24.8 percent of the total advances of commercial banks, has a share of 51.1 percent in the total stressed advances. Of this, infrastructure and iron & steel have significant contribution in total stressed advances. They alone constitute 40 percent of the total and PSBs have maximum exposure to them. Of the five, infrastructure is where most of the trouble is. As on 17 April 2015, banks have lent Rs 9.33 lakh crore loans to infrastructure, which primarily consists of power, telecommunications and roads. This part of the loan book has sharply risen by nearly 11 percent over the year. Now, what is to be noted here is that while public sector banks’ share to infrastructure loans as a percentage of total advances is about 18 percent, their share in stressed advances is about 31 percent. Compared with this, private sector banks have an 8.4 percent share to infrastructure loans, while the stress percent from this segment for these banks is 18.2 percent.  Second to infrastructure is the power sector. Again PSBs are the worst hit. While their share to power loans as a percentage of total advances is about 10.1 percent, the percentage of stressed assets in this segment is about 17.3 percent. For the private sector, this share is 3.8 percent and 7.3 percent, respectively. “Sectoral credit stress tests were also conducted for the infrastructure segment, including on a few important sub-sectors of power, transport and telecommunication. The tests revealed that the shocks on the infrastructure segment would significantly impact the system with the most significant effect of the single sector shock being in the power and transport sectors,” the RBI has said in the report. Stressed assets refer to a mix of bad and restructured loans. According to FSR, such loans are already close to 13 percent for state-run banks. It expects the gross non-performing assets to reach 5.9 percent of the total loans in a worst case scenario from 4.6 percent in March 2015. In absolute terms, 40 listed Indian banks have gross NPAs of over Rs 3 lakh crore. Stressed assets are cancerous to the balance sheets of banks since they require higher provisioning. Since April 2015, banks do not have the flexibility to masquerade bad loans as restructured loans since the RBI has taken away the regulatory forbearance on such loans. According to the new norms, provisioning for a Rs 100 loan that has been recast will be a minimum of Rs 15. If the asset fails to recover, the provisioning can go up to Rs 100.  The real magnitude of the FSR warnings will become clearer only when they are read along with another set of data — corporate debt restructuring (CDR) numbers. Infrastructure is the top segment in the CDR list, constituting almost 20 percent of the total Rs 2.86 lakh crore restructured loans. Infrastructure, along with iron and steel, constitute 40 percent of the total CDR loans. The bottomline is that the level of stressed assets from infrastructure and related areas has risen to a level where some of the weak lenders are sinking. As the RBI has warned, project delays are the major reasons why things have worsened to this extent. When projects fail to meet the promised date of commencement of operations (mainly clearance issues), this leads to cost overrun and stress on corporate balance sheet. Also, the aggression with which the banking industry pushed credit to infrastructure projects until 2010 has evidently backfired. Bankers themselves have admitted that it is the laxity in assessing the credit quality, in a bid to garner maximum business, that has resulted in the current higher NPAs. The steel sector too has suffered from delays in project implementation in the recent years, adding to the pile of stressed assets, the RBI has said in the FSR. “As on date, five out of the top 10 private steel producing companies are under severe stress on account of delayed implementation of their projects due to land acquisition and environmental clearances among other factors,” RBI has said. For Jaitley, the FSR should act as an eye-opener before it is too late and the problem becomes too big. The solution to resolve the infrastructure woes of banks lies in faster clearances of projects and getting alternative funding channels (multilateral agencies and long-term funds) to fund Indian infrastructure. Funding long gestation infrastructure projects shouldn’t be the burden of banking sector alone. If the government manages to get going the stalled infrastructure projects, that itself can ease the pressure on banks. But the fact is that the initial optimism with respect to faster reform push and ease of doing business has started to wane, prompting corporates not to go ahead with any fresh investment commitment. This means, a larger share of the investment should come from the government’s coffers. The stress currently seen in the banking sector, especially in the infra segment, is a reflection of the slow progress in the reform process and would remain so until the situation on the ground improves. Land acquisition for projects continues to be a major risk area for companies and the NDA government is nowhere close to pulling it off given the strong opposition from political rivals. State-run banks, in particular, are already in a dangerous position on account of three major issues — shortage of capital, lack of autonomy and the huge level of stressed assets. The RBI report rightly warns that PSBs, which had the highest expected loss as percent of their total advances among the bank groups, are likely to fall short in terms of having sufficient provisions to meet their expected losses under adverse macroeconomic risk scenarios. Jaitley should take note. (Data support from Kishor Kadam)

State-run banks, in particular, are already in a dangerous position on account of three major issues — shortage of capital, lack of autonomy and the huge level of stressed assets

Advertisement

End of Article

)

)

)

)

)

)

)

)

)