New Delhi: That Tata Motors is in serious trouble in the domestic passenger vehicle market is no longer in doubt. According to a report by Morgan Stanley analysts Binay Singh and Shreya Gaunekar this morning, the company has lost more than five percent market share in cars and MPVs in 12 months ending this February to settle at 9.7 percent while its UV market share has more than halved to 5.5 percent from 15.3 percent in the same 12-month period.

In February alone, the company saw year-on-year 62 percent decline in domestic sales of cars and UVs at 10,613 vehicles. A story in the Economic Times speaks of market share in passenger car segment falling to its lowest level of 4.9 percent in February in a decade. While it is true that the passenger car market is declining itself but Tata’s steep fall is much faster than anyone else’s and this is where the concern arises from. Is it time to give up on Tata Motors?

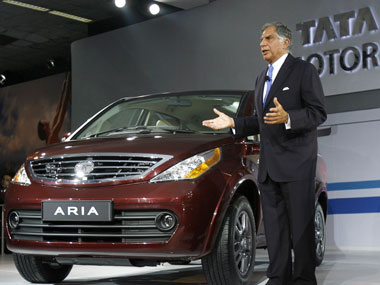

[caption id=“attachment_659110” align=“alignleft” width=“380”] Domestic business accounts for less than 30 percent or less. Reuters[/caption]

Analysts and automobile industry experts have long pointed towards absence of new products and a streamlined marketing and distribution strategy for Tata cars which has led to the present state. But the company’s increased focus on its global sales and the Jaguar Land Rover business in the last few years could have also led to the crisis. Domestic business accounts for less than 30 percent or less than a third of the company with the marque JLR driving its business primarily.

An industry veteran says the “PSU like” culture at Tata Motors has also contributed to the company’s decline in the domestic market. He says even if right decisions on product and positioning are taken, they get diluted and implementation remains weak.

Impact Shorts

More ShortsThe company has, in the last few months, seen many changes beginning with the appointment of ex-GM India head Karl Slym as Managing Director. Ranjeet Yadav now heads the entire passenger car business unit, Neeraj Garg is VP Commercial, R Venkat heads Purchasing. New people have also come in to lead other functions as well. This infusion of new blood may help but there is unlikely to be a major change in the way the company works immediately.

Already, Slym has begun speaking of a course correction. He was quoted by agencies last week saying that “In passenger cars, we are not in a strong position. We have lost market share. There are segments that are booming in which we don’t have products. On new products, new features, new launches, we have been rather quiet, we need to change that.”

After Slym took charge in August last year, Tata Motors has reorganised its passenger car division with a target of becoming India’s number two player by 2020. It has refreshed the Manza, Vista, Aria and Safari. But the company has not launched a new product in two years and has launched just four cars - Vista, Indigo Manza, Nano and Aria - in the past 10.

Now, people’s aversion to old car models and an overall decline in car buying has meant that more than half the production capacity at Tata Motors now stands unutilised, market share is plunging month on month and the company has had to recently offer never-before discounts. From last week, Tata Motors’ cars come with a discount of anywhere between Rs 29,000 and Rs 50,000 apart from other incentives such as a buyback assurance. It is apparent that liquidating piled up inventory is Tata Motors’ biggest worry as of now.

An analyst with a leading brokerage points out that the company just needs to get its product strategy right, all its other pillars such as R&D, manufacturing, distribution etc are well in place. He also suggests that Tata Motors needs to reduce the price of the Nano to gain economies of scale. The Nano is already the cheapest car in the world. Will Slym take the gamble and actually slash prices? Nano sales fell over 7 percent between April to January of this fiscal to 50,836 units versus 54,835 units. They fell further to just 1505 units in February against 9217 units in an year ago period. Slym has spoken on coming up with a Nano refresh and the diesel version this year.

Meanwhile, a leading automobile vendor points out that the company has been working on a car between the Nano and the Indica for two-three years now but has been unable to arrive at any decisive product. “Don’t expect any miracles from Tata Motors for the next two-three years. The company will gain some momentum in 2015-16 when new products begin to hit the market, till then its pretty much downhill,” this vendor said.

As long as work has begun in right earnest at new products, perhaps Tata Motors stands a fair chance of gaining back momentum in the next couple of years. But till then, the company may see much pain.

)

)

)

)

)

)

)

)

)