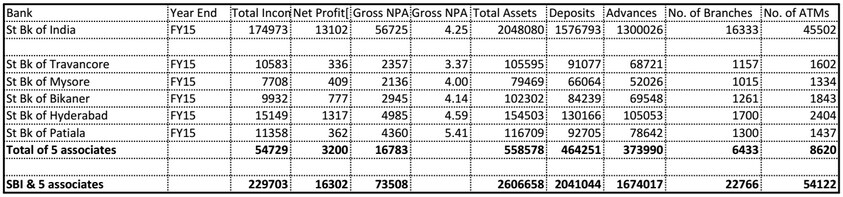

The country’s largest lender, State Bank of India (SBI) could consider de-linking its subsidiaries from the parent instead of merging with itself, if the idea makes sense for the bank in terms of business and standalone performance of the associates, said O P Bhatt, former chairman of the bank. “Some of the subsidiaries are doing well and can grow on their own,” Bhatt told Firstpost speaking on the sidelines of DBS Asia Insights Conference 2015 in Singapore. [caption id=“attachment_2342016” align=“alignleft” width=“380”]  OP Bhatt. IBNLive image[/caption] “They can be de-linked from the parent if it is right (for the bank),” Bhatt said, adding that an option to merge them with other PSU banks can also be considered, when asked about the strategy the bank should adopt with respect to associate banks, going ahead. SBI had merged two of its subsidiaries State Bank of Saurashtra and State Bank of Indore during Bhatt’s time, in 2008 and 2010, respectively. The bank has since put the merger plans of remaining associates on hold on account of apprehensions related to integration issues. At present, SBI has five remaining subsidiaries - State Bank of Bikaner and Jaipur, State Bank of Travancore, State Bank of Mysore, State Bank of Hyderabad and State Bank of Patiala - of which first three are listed. SBI and its associates together have total assets of Rs 26,06,658 crore as of March 2015. The five associates together constitute only one-fifth (Rs 5,58,578 crore) of the total asset size of the State bank group. Similarly, the associates constitute 23 percent of total group deposits, 22 percent of the combined advances and 28 percent of the branches.  In other words, SBI, even on a standalone basis, is a giant in the group and even without amalgamations it could grow even bigger within few years. The bank already have strong presence with its 16,333 strong branch network across the country, including in the areas where the associates are present. Merging associates doesn’t give any special advantage. All five associates together constitute 6,400 branches. That apart, sale of associates can also help SBI mobilise significant amount of capital to fund its expansion plans. At present, SBI holds 75 percent stake in State Bank of Bikaner and Jaipur, 90 percent in State Bank of Mysore and 79 percent in Travancore. A rough calculation shows that, at the current market prices, theoretically, this holding would fetch close to Rs 7,000 crore. In fact, the bank is unlikely to face any major opposition from such an exercise from employee unions since unions themselves have demanded total de-linking of the remaining five associates from SBI and thus, become financially independent. Also, the current management is not very keen to go ahead with mergers due to the issues related to integration. In the past, SBI chairman Arundhati Bhattacharya had said that HR integration issues come first among the challenges faced in the event of a merger. “Believe me, in a merger, the thing that causes the biggest pain is HR,” Bhattacharya had said. India’s state-run banks are reeling under severe stress due to shortage of capital and high level of stressed assets on their books. Banks need at least Rs 2.4 lakh crore capital by 2019 to meet the Basel-III norms alone. Besides, they need significant chunk of capital to make provisions on bad loans and fund business expansion when credit growth picks up. Of the Rs 3 lakh crore bad loans of the banking sector, over 90 per cent is on the balance sheet of state-run banks. The Narendra Modi government is grappling with the problem of bank recapitalisation due to absence of sufficient fiscal room. Recently, the Reserve Bank of India had cautioned the government about the need to urgently recapitalize banks.

the bank is unlikely to face any major opposition from such an exercise from employee unions since unions themselves have demanded total de-linking of the arms

Advertisement

End of Article

)

)

)

)

)

)

)

)

)