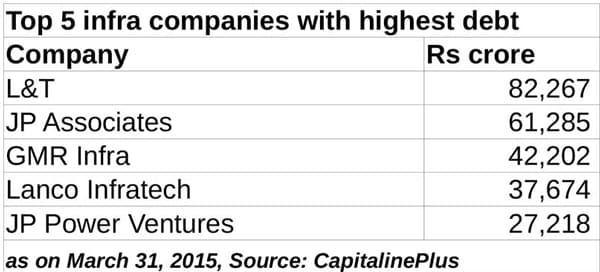

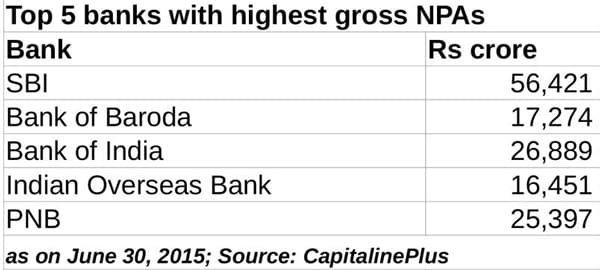

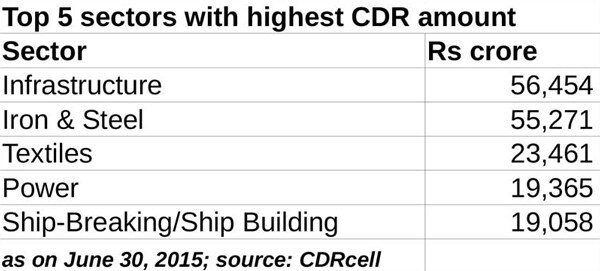

There are two key takeaways from Prime Minister Narendra Modi’s three-hour long meeting with top industrialists, economists and central bank chief on Tuesday. For one, the government wants the private sector to take risks and invest more in the economy; secondly, both the government and the industries are desperate for lower cost of capital, which essentially means more pressure on Reserve Bank of India (RBI) governor Raghuram Rajan to cut rates. The Modi government rightly feels that Indian economy should take advantage of the current global slowdown by rebooting the domestic growth engines. The government wants the private sector to take the lead. “Private sector has greater risk-taking ability and they should increase investments,” Jaitley said in a presser that followed the meeting. [caption id=“attachment_2423140” align=“alignleft” width=“380”]  PM Narendra Modi. PTI[/caption] But, the call to the private investors is likely to fall on deaf ears for the simple reason that the private sector is already at big risk and their capacity of further risk-taking is severely constrained on account of various factors. Most companies, especially in infrastructure, are just not in a position to increase their investments for reasons well known to the government. “I don’t know how many people can go ahead to take risk and invest,” PTI quoted FICCI (Federation of Indian Chambers of Commerce and Industry) President Jyotsna Suri as saying after meeting the prime minister. Industry associations continue to look at RBI rate cut as the single cure to their current state of difficulty as if high interest costs are the only issue. Interest cost is, but, one part of the problem. The are much deeper and bigger problems that need to be addressed. Why companies wouldn’t take more risk First and foremost, most infrastructure companies are highly debt-ridden and over-leveraged. Many projects are delayed for want of various clearances. Such delays have resulted in huge cost-overruns, adding to the project cost and making many projects unviable. Speeding up project clearances and ensuring a conducive environment to do business on the ground haven’t happened in the way originally promised by the Modi government. Fresh investments continue to elude the infrastructure sector, whereas India needs about $1 trillion under the current five-year plan period to fill the funding gaps of its infrastructure sector. The present state of the sector is well reflected in the restructured loan books of banks. If one looks at the sector-wise distribution of the corporate debt restructured (CDR) loans, the extent of stress is quite visible. Steel, cement and iron segments continue to be highly stressed. In fact, many debt-ridden infrastructure companies are struggling to pare their debts by selling non-core assets. Unless their books are de-stressed, it isn’t likely that they would stick their neck out further and add to their current woes. Here, the government needs to do three things: 1) Approach stalled projects on a case-to-case basis and see where exactly the project is stuck, find solutions. Also promoters need to be given exit route if projects are unviable; 2) Push up public spending in a big way to develop roads, railways and ports and facilitate foreign capital where it doesn’t have the wherewithal to spend, for example railways; 3) Work out funding channels for long-gestation projects such as the takeout financing route. Why banks wouldn’t take risk The banking sector is unable to lend more on account of severe asset quality issues and due to a growing trust deficit with the corporate clients, who wouldn’t pay back.  Banks are also facing stress on capital. Government banks, which dominate 70 percent of the banking sector, continue to line up with begging bowls at their owner’s door every now and then for capital. Also they are unable to attract private investments, due to their prevailing weak financial position. The current state of NPAs (non-performing assets) on the books of banks (see the table) wouldn’t let banks to push lending in a massive way even if credit demand picks up.  To be sure, there isn’t any demand for bank credit as reflected in the banking lending. According to the RBI’s data, bank lending to industries grew by a mere 4.8 percent in July 2015 as compared with the increase of 10.2 percent in July 2014. In short, the over-indebted, over-leveraged companies and stressed and capital-starved banks aren’t in a position to sit across a table and discuss fresh funding plans. The big job at hand for the government is to repair the existing stock of stalled projects and address the stress in the banking system.  Currently, over Rs 3 lakh crore loans are NPAs on the books of Indian banks and about Rs 5-6 lakh crore are on the restructured books, on a conservative basis. With about 11-13 percent of loans under the stressed category and the RBI stepping up scrutiny on bad loans, how do one expect banks to take further risks? Here the government should do two things: 1) It must instill confidence in the banking system that if banks lend to large corporations and if the companies default, the prevailing rules and regulations wouldn’t come in the way of lenders in recovering their loans. The government shouldn’t delay the formulation of bankruptcy code any further, which it promised in the Union Budget. Banks are still sitting ducks before large influential corporations such as Kingfisher, which owe thousands of crores to banks. The government needs to look at what exactly is preventing the recovery and support banks in the process. Wilful defaulters – companies which have the ability to pay back but wouldn’t do so – constitute a significant chunk of the dues of the banks. Unless the bad loan problem is addressed, banks wouldn’t take further risks. 2) It should kick off radical reforms in the banking sector by privatising some of the state-run banks and merging a few others, wherever there is synergy. Privatisation is the only way out to professionalise sarkari banks and help them meet their long-term capital needs. In the short term, state-run banks needs large doses of capital to resume credit expansion. Why wouldn’t investors take risks The Modi government is fighting a trust deficit with both foreign and domestic investors with respect to the promise of growth-oriented reforms in the economy. The government is still struggling to push many key reform bills such as easing of land acquisition for businesses, GST and labor reforms. The government will have to consensus among opposition parties to push key reforms, mere blaming of the Congress wouldn’t do. The initial euphoria on Modi’s arrival at the Centre has waned and his pro-business image has certainly taken a beating. Foreign investors are now increasingly more skeptical about his and his team’s ability to pull off large-ticket reforms. The government should regain the lost investor faith. At this stage, things do not appear positive. The Sensex, India’s benchmark equity index, is back to pre-Modi levels and foreign institutional investors have been pulling funds out of the country, in turn, putting pressure on the rupee, also partly due to the global turmoil. The short message is this: At the moment, if the Modi government expects the private sector to take the lead that would just be wishful thinking. The initial push must come from the government in the form of higher public spending and reform progress. For now, the ball is in government’s court and there is a lot more work to be done before private investors stick their neck out in the game. (Kishor Kadam contributed to the story)

There is a lot more work to be done before private investors stick their neck out in the game

Advertisement

End of Article

)

)

)

)

)

)

)

)

)