Why did Aditya Puri leave Citibank and accept a huge salary-cut to join an uncertain start-up called HDFC Bank? Why was Deepak Parekh, so keen to start a bank, reluctant to even lend the offspring his organisation’s brandname? In today’s world, does it make sense to run a housing finance company called HDFC when there is a bank of the same name?

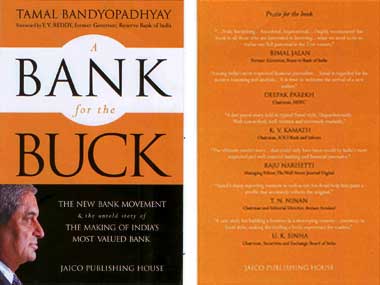

To find answers to these questions you need to read Tamal Bandyopadhyay’s Bank for the Buck, which tells you the story of “India’s most valued bank”. The answers are, in the order of the questions above, 1) Parekh personally went to Malaysia to convince Puri to head the start-up bank and promised him complete operational freedom; 2) Parekh worried that if the bank did not do well, it would impact the equity of the housing finance parent company; and 3) the main factor deterring a merger is the high immediate cost of maintaining cash and statutory liquidity reserves on the housing company’s liabilities.[caption id=“attachment_569944” align=“alignleft” width=“380”]  Cover of the book. Image courtesy Tamal Bandyopadhyay[/caption]

Bank for the Buck may be a rather inelegantly-named book, but it makes for a delightful read. There is no jargon, no confusing terminology, no beating around the bush with arcane detail. Every story or sub-story in the book is anecdotal, easy to comprehend and savour.

At the end of the book you may still be left wondering what exactly made the bank such a huge success, but the ride is so good that you can read it all in one sitting and love it all.

Luck, pedigree and timing may have contributed a lot to HDFC Bank’s success, but the interesting thing about the bank is not that it was a pioneer in everything, but that it made so few mistakes in its early life - at least none it needs to be ashamed of.

One such mistake was a tie-up with National Westminster-not surprising, since Indians tend to go ga-ga over foreign collaborations-but this association brought no value to the bank and NatWest exited at a huge profit.

Impact Shorts

More ShortsToday it may sound silly that among the names HDFC thought of for its bank were Everest Bank of India, or Greater Bank of Bombay, or Bombay International Bank (wonder what the late Sena Pramukh would have thought of the recurring ‘Bombay’ theme in the discarded names), but all ideas start with blue skies thinking. HDFC’s was too.

The key to its initial success probably lay in the fact that HDFC preferred the solid conservatism of the tried and tested to the new. This often meant that other banks pioneered new ideas, but HDFC Bank could jump in once a concept was proven. It took very few big risks.

Thus while ICICI Bank, UTI Bank (now Axis Bank) and IDBI Bank all made huge mistakes and courted either a large book of bad loans or failed projects, HDFC Bank almost never faltered. Even while rival promoters got their fingers burnt with their new generation banks (Timesbank, Centurion Bank, Bank of Punjab, et al), HDFC Bank started off at a steady and safe trot and picked up the failing new-gen banks when they were ripe for it.

Unlike ICICI Bank, which made flamboyant acquisitions which it later regretted (Bank of Madura), HDFC grew steadily and made only small acquisitions - including Timesbank and Centurion Bank of Punjab, the latter itself being the result of one previous merger. IDBI Bank, which achieved a rebirth under Gunit Chadha (ex-Citibank), was finally swallowed up by its parent IDBI, which wanted to convert itself from a financial institution to a bank.

HDFC Bank’s big advantage was that it was quick to learn and adapt to the market. Aditya Puri’s original idea was that he would create a corporate bank - where he would raise money from retail depositors and lend to corporations. This was what provided it the initial solidity.

But the focus soon had to be changed when ICICI Bank, which was transforming itself from a long-term project lender to commercial banker, went the whole hog for retail banking-everything from housing loans to auto loans to credit cards-and was growing exponentially. ICICI was also a first mover in technology, expanding its ATM network at a frenetic pace and launching mass internet banking and trading when other banks were still testing the waters.

HDFC Bank didn’t move first or fast, but when it did it did so with the surefootedness of a pro.

There are few journalists as well equipped as Tamal Bandyopadhyay to write about Indian banking. There are even fewer journalists who can write about India’s most successful private sector bank with the felicity of an insider who knew how it all happened. Which is why Bank for the Buck is a must read. It is the inside story by an outsider who had a ringside view and access to all the players in the game - from the regulator down to insiders in the bank.

Bank for the Buck, By Tamal Bandyopadhyay, Paperback edition, 344 pp, Jaico Books.

)

)

)

)

)

)

)

)

)