The clearest signs that Infosys has started to do something about its dismal performance came on a day when the markets dumped the stock like never before in the last 10 years, when analysts panned it as if its numbers were a personal affront, and when the media seemed to almost write it off.

On Friday, a day after Karnataka celebrated Ugadi, or new year, Infosys said it would grow slower than the industry in the coming year - at 6-10 percent compared to Nasscom projections of 12-14 percent. It didn’t give EPS (earnings per share) guidance. Just last quarter, it seemed as if the company would meet its full year guidance. It didn’t. Its shares were down 20 percent, the biggest fall since 2003.

As in the last several quarters, Infosys blamed the macroeconomic environment for its performance and sought more time for its new strategy based on products and platforms to yield results. Infosys CEO SD Shibulal tends to repeat his key message in the form of a phrase or a word. Yesterday, the word was ‘volatility’.

But there were also signs that Infosys has changed tack.

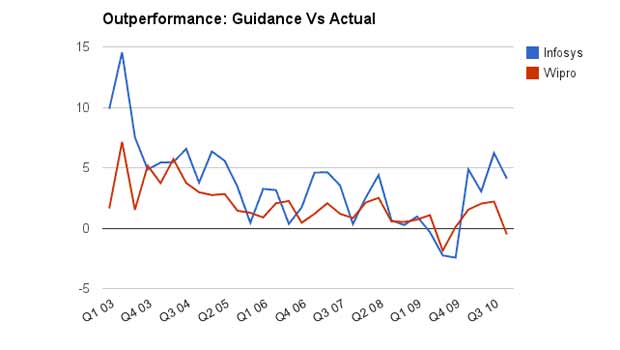

For long, the stock market loved Infosys, and in some ways, Infosys played to its whims. It’s most evident in the way the company outperformed its own guidance. Its annual revenues went ahead of its guidance by more than 10 percent in four out of the last 12 years. Contrast it with Wipro, which doesn’t have to pander to the market the way Infosys does, because Azim Premji owns most of it. Here’s how the chart looks. (TCS doesn’t give guidance).

So, what’s wrong with stepping on the guidance treadmill? It consumes a lot of management time and energy, it shifts the attention to the short term, and studies suggest, it doesn’t even result in higher valuation. Some years ago, McKinsey looked at the scene and found that the costs of earning guidance outweighed the benefits.

Impact Shorts

More ShortsIt wrote: “When Coca-Cola stopped issuing guidance, in late 2002, its executives had concluded that providing short-term results actually_prevented_management from focusing meaningfully on strategic initiatives to build its business and succeed over the long term. Instead of indicating weak earnings, Gary Fayard (who was then CFO) believed that the move signaled a renewed focus on long-term goals.”

In fact, some leaders have gone a step further and even questioned the practice of quarterly reports: Unliver’s Paul Polman, writing in Forbes India’s 3rd Anniversary issue, argued: “The requirement to report back to investors every 90 days distorts behaviour and priorities. It is absurd for complex multinational companies to have to invest huge amounts of time preparing detailed income and margin statements every quarter.”

[caption id=“attachment_697815” align=“alignleft” width=“380”]  Reuters[/caption]

The good news is Infosys seems to be taking some baby steps towards it. A few quarters ago, it stopped issued quarterly earnings guidance, and this quarter it declined to give EPS guidance. (Even its revenue guidance has a rather wide range of 6-10 percent. (Another unrelated move, but philosophically in the same direction, is its decision to increase the fixed component of employees’ salary. It reinforces long term thinking.)

Shibulal insists that the reason for not giving quarterly guidance, and for keeping its annual guidance under such a broad band is the lack of visibility. But, the strains of having to answer questions from the market are clearly showing on the management. It’s not clear if they will decide to stop giving guidance, but the direction seems to be towards that.

The second change is about the story they have been telling investors - of being an industry leader in growth and margins. Now, there is always a tradeoff between growth and margins. (Cognizant, for example, traded some of its margins to consistently deliver industry leading growth.) When IT outsourcing had a huge underlying momentum, Infosys, justifiably, turned its efforts towards margins. Its processes were good, its spend on sales and marketing was optimal and it could even say ’no’ to certain types of projects.

However, when that momentum got lost in financial crisis, Infosys struggled to shift to other cylinders of growth - of getting market share through better pricing, or buying companies or getting into partnerships with them. It was not so much about the ability of the management to shift as it was the mindset.

The press conference yesterday indicated that there is a change in this mindset. Growth, Shibulal said, is one of the best ways to get margins. (In fact, he repeated the growth mantra so many times that a journalist asked if the company would from now on go full-fledged after growth).

While he used to speak of acquisitions as ‘falling in love’, he spoke about it as a strategic choice to pursue growth. That the company acquired Lodestone last year (besides being more open to partnerships), gives his statement credence. There is still reluctance to spend on front-end marketing (its sales and general administration expenses as a percentage of sales continue to be low). However, its competitors say it has gotten more aggressive on pricing and is taking up projects with skewed cash-flows.

At Infosys, the traditional tightfistedness about acquisitions naturally extended to how it saw investments even within the company. At least two former senior executives told me that it has never been easy to get a new initiative approved by the top management. Even when it decides to go ahead with an initiative, getting a big budget for it can be frustrating. There is a sign that it’s changing too. Infosys announced it is setting aside $ 100 million for a fund that would incubate ideas from within and invest in ideas from outside. By no means is this idea radical, but it certainly indicates a clear deviation from the conservative approach to new initiatives.

While all these are good signs, it’s important to remember why they got lost on the observers. For two reasons. One is the management’s broader commentary on the economy and demand situation today. It’s volatile. Mangers across the world and across sectors tend to underspend when there’s uncertainty, and that’s showing on IT demand.

It’s especially harsh on Infosys because of its portfolio mix. Shibulal loses no opportunity to point out that close to a third of company’s revenues depend on discretionary spending compared to about 15 percent for the industry as a whole. Second, the company also made it clear that products and platforms cannot suddenly start driving its growth. It will take time.

Yet, these signs are important because they indicate how the company hopes to steer the ship till then.

)

)

)

)

)

)

)

)

)