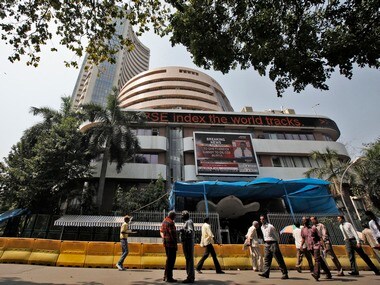

Mumbai: Logging second straight weekly gain, the benchmark BSE Sensex today rose 118 points to 27,324 on forecast of a timely monsoon, while Finance Minister Arun Jaitley saying economy was in a recovery mode with inflation and fiscal deficit under control too boosted sentiment.[caption id=“attachment_2114339” align=“alignleft” width=“380”]  On a high. Reuters[/caption] Besides, slowdown in foreign funds outflows amid firm European shares also buoyed market, traders said. Finance Minister Arun Jaitley had yesterday said the economy was in a recovery mode with inflation and fiscal deficit under control. “Sentiments turned upbeat as investors remained hopeful of RBI slashing the key policy rate in the upcoming monetary policy review,” said Jayant Manglik, president of retail distribution at Religare Securities. Inflation cooling to a four-month low in April and industrial output growth at a five-month low in March is stocking hopes of an interest rate cut by the Reserve Bank. In volatile movements, the 30-share Sensex opened firm at 27,233.90 and made further headway to touch the day’s high of 27,379.57 led by gains in rate-sensitive stocks. However, on emergence of profit-booking, it briefly slipped into the negative zone to touch day’s low of 27,159.76, but staged a strong comeback to close 117.94 points or 0.43 percent higher at 27,324. The index had shed 45.04 points in yesterday’s trade. The 50-share NSE Nifty also ended 38.15 points or 0.46 percent higher at 8,262.35 after moving between 8,279.20 and 8,212.20 intra-day. “Today’s lacklustre performance in equity indices suggest that traders are not overjoyed as they estimate that the rate cut prospects may be tempered by monsoon expectations,” said Anand James, Co Head Technical Research Desk, Geojit BNP Paribas. The IMD has forecasted that monsoon may hit the Kerala coast on 30 May even as the country stares at the possibility of below normal rains for a second consecutive year. The rise in the BSE barometer was supported by gains in state-run SBI that climbed 2.39 percent, followed by HDFC 1.80 percent and Axis Bank 0.80 percent. Bharti Airtel, M&M, Infosys, ONGC, Maruti Suzuki, L&T, Bajaj Auto and Tata Motors were among other gainers. The broader markets also rose as the small-cap and mid-cap indices rose 0.62 and 0.35 percent, respectively. Rally in the rupee value to near 63.50 against the dollar also aided the uptrend. On the global front, key indices from Hong Kong, Japan and Singapore ended firm, while those from China, South Korea and Taiwan finished lower. European stocks, however, were trading firm in their late morning deals. The France CAC was up by 0.54 percent, Germany DAX by 0.47 percent and the UK FTSE by 0.43 percent. The Dow Jones rose 1.06 percent and the tech-heavy Nasdaq surged 1.39 percent yesterday. Moreover, S&P 500 index logged its new closing peak. Back home, Foreign portfolio investors (FPIs) sold shares worth Rs 73.75 crore yesterday, as per provisional data. “…all was not good in this week as FIIs booked some profit and were the net sellers of the shares worth Rs 1,304 crore till Thursday as concern over tax issue related to FIIs remained unsolved,” said Jignesh Chaudhary, Head of Research at Veracity Broking Services. Out of 30 Sensex stocks, 16 ended in the positive zone. Major gainers were SBI (2.39 percent), HDFC (1.80 percent), Bharti Airtel (1.80 percent), M&M (1.42 percent), Infosys (1.30 percent) and Axis Bank (0.80 percent). While NTPC was biggest loser on the day with a fall of 2.05 percent, followed by Vedanta 2.01 percent, Coal India 0.85 per cent and ICICI Bank 0.76 percent. Among the BSE sectoral indices, consumer durables rose by 0.81 percent, followed by teck 0.69 percent, FMCG 0.67 percent, healthcare 0.65 percent, IT 0.65 percent and auto 0.59 percent. However, realty fell 1.33 percent, while Metal dipped 1.05 percent. Total market breadth remained positive as 1,455 stocks ended higher, while 1,234 stocks finished lower with 115 ruling steady. The total turnover fell to Rs 2,533 crore from Rs 2,965.41 crore yesterday. PTI

The rise in the BSE barometer was supported by gains in state-run SBI that climbed 2.39 percent, followed by HDFC 1.80 percent and Axis Bank 0.80 percent.

Advertisement

End of Article

Written by FP Archives

see more

)

)

)

)

)

)

)

)

)