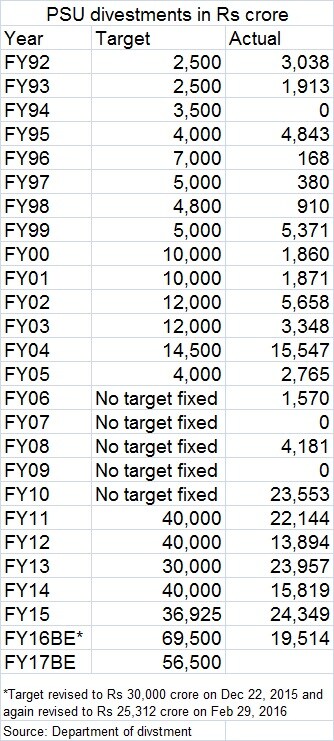

The right word, probably, to describe the sharp downward revision in the disinvestment target 2016 fiscal year by finance minister Arun Jaitley (to Rs 25,000 crore from the originally targeted Rs 70,000 crore) is ‘jugaad’. How else one would describe the logic in setting an ambitious, unachievable target and scaling down it to almost one-third? Yet another ‘jugaad’ is to continue digging into the pockets of state-run insurer, Life Insurance Corporation of India (LIC) to salvage the disinvestment programme to ensure the plan doesn’t flop totally. [caption id=“attachment_2696552” align=“alignleft” width=“380”]  A file photo of Arun Jaitley. PTI[/caption] The Narendra Modi-government managed to raise Rs 19,514 crore through stake sale in PSUs in the fiscal year ending March, including the recent Rs 5,000 crore Offer for Sale (OFS) of National Termal Power Corporation (NTPC). With just three days left in this month, one can assume that this is more or less the final figure. For the fiscal year 2017, the government plans to raise Rs 56,500 crore through PSU disinvestment, of which Rs 36,000 crore is expected to come from minority stake sale in PSUs, while the remaining Rs 20,500 crore from strategic sale in both profit and loss-making companies. The government also plans monetization of land assets of PSUs. Meeting this target is critical for Arun Jaitley to adhere to the fiscal deficit roadmap (3.5 percent in fiscal year 2017) and a repeat of the 2016 flop show could put the deficit management under pressure, especially if tax revenues disappoint and pressure on high public spending and banking sector capital requirements weigh. Going by the past experience, it would be tough for Jaitley to meet the target. In the last 25 years disinvestment process, for which data is available, the governments have failed 16 times to meet the targets even though repeated failures haven’t deterred the governments to announce ambitious (mostly unachievable targets) in the annual budgets. There is no harm in being ambitious but setting a tall target and falling far short of it, when repeated, prompts investors and rating agencies stop trusting the disinvestment target numbers. Hence, it’s time the government did some soul searching why there is repeated failure in meeting the target by big margins and whether its big reliance on LIC for the success of the disinvestment process is right.  There are two issues Jaitley should note here: One, he should begin the 2017 disinvestment process as early as possible and not wait until the end for the right market. The trick, says D K Joshi, chief economist at rating agency Crisil, is to start at the beginning of the year itself. “Unless the government begins the disinvestment process aggressively in the first half, it is going to be very difficult (to meet the target),” said Joshi. One must note that the NDA-government failed to hit the market early after it came to power when markets were riding on the Modi wave. After the sentiment fizzled out, it has constantly blamed the tepid market conditions and was waiting for a good time to resume the process. Jaitley probably realised that the disinvestment process is turning a super flop show (till now , the government had raised only Rs 6,813 crore) toward the second half of the fiscal 2016. Two, the government should seriously consider stopping using LIC to bail out most of the share sales. LIC is an insurance company that should be loyal to policyholders and not a bailout institution or a loyal milch cow as the government thinks it is. In the NTPC issue, LIC bought 60 per cent of the shares, in the process increasing its stake in the company to close to 13 per cent. Quite logically, had LIC not been in the picture, the sale would have been difficult. In the fiscal year 2016 itself, LIC has picked up stakes worth Rs 11,441 crore in Indian Oil Corporation and NTPC. Too much reliance on the state insurer to bail out public issues is an unhealthy practice since this effectively means taking money from one pocket of the government and putting it in the other. This is against the spirit of larger idea of driving the growth of railways on the back of private investments. The government has been depending too much on LIC not just to salvage its disinvestment plan but also for the massive scale up of railways. Going by Suresh Prabhu’s 2016 budget, the government plans to rely heavily on a debt-driven growth strategy, of which Rs 1.5 lakh crore will come from LIC over next five years. Third, if the government fails to time the disinvestment, Jaitley runs the risk of missing the fiscal deficit roadmap in fiscal year 2017. The whole assumption of Arun Jaitley as far as fiscal deficit is concerned is based on the inward revenues (mainly disinvestment and telecom receipts). But, analysts have already flagged caution on this assumption. “The most ambitious aspect of the budget is the 3.5 per cent budget deficit number,” said a research report from Ambit on 1 March. “Given that the FM announced a 10.8% rise in spending, for the FM to deliver a 3.5 per cent deficit he will need 16 per cent total receipts growth in FY17. Whilst the FM has realistically budgeted 11.8 percent growth in tax revenues, he expects the proceeds from disinvestment plus telecom receipts to fetch Rs 1.6 trn in FY17 (vs Rs 0.8 trn in FY16). If this jump in proceeds does not materialize then we will be looking at a budget deficit overshoot (Rs 1 trn = US$15bn = 0.7 per cent of GDP). Specifically, the FM’s explanation that telecom receipts will fetch Rs 1 trillion in FY17 (vs Rs 0.56 trillion in FY16) appears very ambitious,” Ambit said. The short point is this: There aren’t many economists who trust the disinvestment target numbers taking into account the past performances. Setting a realistic target and work early towards achieving this with a convincing roadmap is critical than announcing an over ambitious target and repeatedly failing to achieve the same. Else the whole process would tantamount to a joke. Data contribution by Kishor Kadam

Meeting this target is critical for Arun Jaitley to adhere to the fiscal deficit roadmap (3.5 per cent in fiscal year 2017) and a repeat of the 2016 flop show could put the deficit management under pressure

Advertisement

End of Article

)

)

)

)

)

)

)

)

)