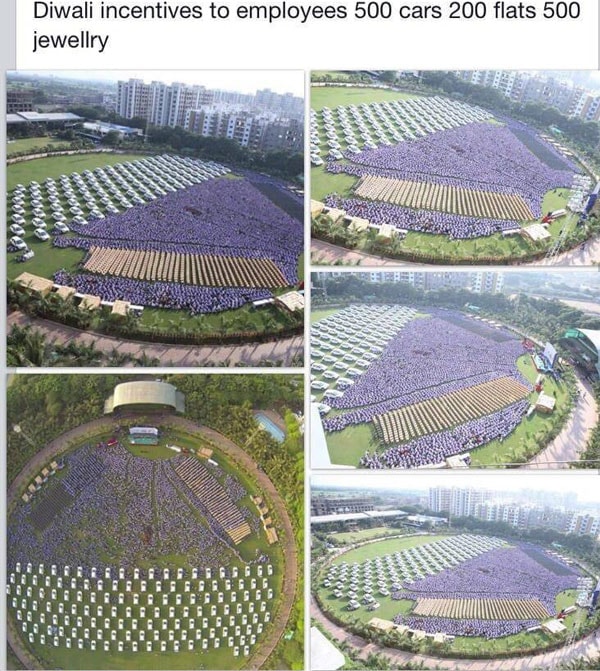

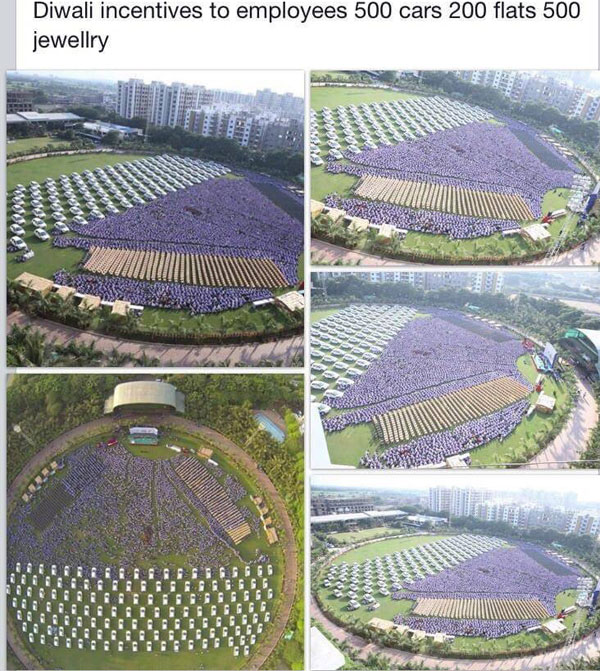

Hari Krishna Exports was in the news last week for its generosity to select employees - 1,200 out of the 6,000 on its rolls - who were rewarded for their loyalty to the company.

The company splurged Rs 50 crore on them by giving them either a 2 bedroom flat or fiat punto car or jewelry, the one they did not own already. As many as 491 employees got cars and 200 got flats with others presumably settling for jewelry. What does this magnanimity portend for the beneficiary-employees in terms of tax liability?

Well, there was some room for tax planning as far as cars were concerned. The income tax law says if a car was owned by the employer before its sale to an employee, the taxable value of this largesse would be cost to the employer less 20% depreciation on the written down value for each year less amount, if ,any recovered from the employee. Hari Krishna Exports could have easily taken advantage of this rather liberal regime. It could have bought 491 cars and asked the employees concerned to use them for business among other things.

[caption id=“attachment_105973” align=“aligncenter” width=“600”]  The company has gifted the employees 491 Fiat Punto cars, 200 two-bedroom houses and jewellery[/caption]

It is common knowledge that practically such employee-centric cars are at the disposal of the employee concerned but the law does not take cognizance of this leeway taken by the employee so long as the employer can prove that the car was essentially for business use.

The employer could have bided his time before transferring the car to the employee i.e. allowed it to be reduced to a negligible written down value. The tax liability would have been hardly anything had this stratagem been adopted.

During these years, the employees would have paid a soft tax on being allowed to use the car for personal purposes as well with the taxable value being Rs 1800 per month if it was a small car and Rs 2,400 per month if it was a big car. Hari Krishna by its over-enthusiasm has exposed 491 employees to a huge tax liability - the entire cost of the car would be added to the taxable salary of these 491 employees, period.

Those who got two bedroom flats too could have been protected from huge tax liability. While immovable properties do not figure in the concessional tax calculus of sale to employees, the employer nevertheless could have gotten these flats registered in its name and given them as rent-free accommodation which attracts a highly concessional taxable amount – 15% of salary if the place has population in excess of 25 lakh which presumably is the case with Surat.

To wit, if an employee’s basic salary is Rs 50,000 per month, 15% of this would get added to the taxable salary towards the value of rent-free accommodation provided by the employer. It is immaterial if the market rent for such a flat is more or less than this amount.

Given the skyrocketing rents in cities, the regime proves beneficial for employees. But Hari Krishna by its sheer over enthusiasm has once again exposed these 200 employees to tax liability on the entire cost of the house paid on their behalf by their employer.

Now comes the issue of transfer of ownership. Well, Hari Krishana could have easily entered into an agreement to sell post retirement of the employees with the cost being the sale consideration. In the post retirement phase, one’s taxable income plummets and with that the tax liability.

In other words, even if the taxman attributes the sale to the employer-employee relationship that subsisted earlier, not much damage would be done given the considerably reduced taxable income in the post-retirement phase of an employee.

A stock option scheme is basically an employee retention strategy. Hari Krishna could have used its car and flat schemes as a retention strategy by selling cars and flats at a future date as described above.

Those who got jewelry, of course, had it in any case with there being no tax elbowroom for jewelry - they would have to pay tax on the value of jewelry received. In all the three cases, however, a small mercy is available - Rs 5000 per year is exempt from tax by way of gift from employer.

Assuming that Hari Krishna has not resorted to these tax planning techniques, the problem for the beneficiary-employees would be compounded in that they get a far less take home salary thanks to the heightened tax deducted at source from salary.

Indeed, they may have to pay advance tax should the cash salary be just not enough to permit the employer to put a large shovel into it by way of TDS. Where would they mobilise the money from?

Certainly not by disposing of the assets namely car, jewelry or house. Of course, Hari Krishna can heap magnanimity on magnanimity by agreeing to pay tax on these non-monetary perquisites on behalf of the employees which would be outside the pale of tax under Section 10 (10CC).

In other words, if the tax on these non-monetary perquisites is discharged on behalf of the beneficiary-employees by Hari Krishna Exports, the tax thus paid would not be added to the employees’ taxable income which would have been the case had there been no specific exemption under section 10(10CC).

)

)

)

)

)

)

)

)

)