The realty sector seems to be in a tight spot. While, on one hand, it is struggling with high interest rates and slower demand, on the other it is facing the ire or regulators. The Rs 630 crore penalty imposed by the Competition Commission of India (CCI) on India’s largest real estate developer, DLF, has sent shivers down the spines of real estate companies - and their stocks have hit the skids.

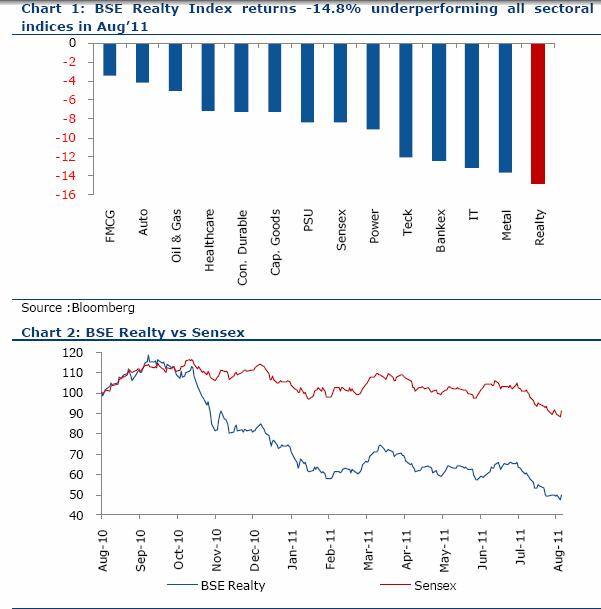

This sentiment was reflected in the BSE realty index which fell by a sharp 14.76 percent over the last one month compared to the BSE Sensex which fell 8.36 percent.

The CCI’s penalty on DLF - which is sure to be legally challenged - may open a pandora’s box for the real estate industry as there are so many projects where real estate developers have not delivered as promised, says HDFC Securities in its latest release on the sector. The CCI had imposed a penalty of Rs630 crore, or 7 percent of its average turnover for the last three years, on DLF after a complaint was filed by the Belaire Owners Association at Gurgaon citing delayed delivery of projects and changes in the building structure.

[caption id=“attachment_75814” align=“alignleft” width=“512” caption=“Fund raising another big issue for developers. AFP”]  [/caption]

Since the verdict, the CCI has received up to 40 consumer complaints against real estate companies across the country, and there are 10 to 11 cases that are being looked into and whose verdict is expected soon, said the report.

Impact Shorts

More ShortsIn fact, the CCI also plans to check if other real estate companies are practising similar norms and plans to fine them accordingly.

However, there are many experts who feel that a large number of builders will be excluded from this action as it will be difficult for CCI to prove that the company is a dominant player in a particular market and that it has abused its position. Normally, action against real estate companies is taken by consumer and other courts. The CCI managed to get into the DLF case by virtue of its dominance in a particular segment of the Gurgaon market.

While regulatory issues are at one end of the spectrum, real estate companies are also experiencing a general slowdown in sales. Ramesh Nair, India Managing Director, Jones Lang LaSalle, expects the Indian real estate sector to see a gloomy phase in the next 12 months as developers face a liquidity crunch, low sales and pressure on margins.

While projects will be delayed and unsold housing stocks will rise, developers might have to offer new projects at discounts of 10-15 percent, he added. In Mumbai, residential sales had dropped to a 30-month low for the quarter ended June owing to record home prices and higher interest rates, says Liases Foras.

To make matters worse, real estate companies are also facing difficulties in raising money. While Jones Lang LaSalle expects bank lending to the real estate sector to tighten, companies will are also finding it increasingly difficult to raise money via private equity (PE) or institutional placements.

According to the HFDC Securities report, poor investor sentiment along with a perception that PE-backed funds could lead to a conflict of interest has made it difficult for developers from taking up any fresh project.

While funds like CIG Realty Funds (Rs 300 crore) and Ackruti City in partnership with Pacifica and Beekman (Rs250 crore) are yet to close, Shapoorji Pallonji’s $500 million realty fund may close at $300 million. Anshul Jain, CEO, DTZ, expects “PE investment in the form of rescue capital and finishing capital in the residential segment”.

)

)

)

)

)

)

)

)

)